Long-term Investing in Tesla Stock: Products, Dividend, Financial Statements, and More

🚗💡 Tesla is a revolutionary company, leading the charge in electric vehicle and clean energy innovation.

Contents

Products and Services 🔍

The products of Tesla are not just innovative, but also have a great potential to positively impact our lives and the environment.

1. Model 3: The Electric Dream 🚗💭

The Tesla Model 3 is not just a car; it's an electric revolution on wheels! With its affordable price tag, impressive range, and zippy performance, the Model 3 is making electric vehicles (EVs) a reality for the everyday driver.

2. Semi Truck: Big Rig, Bigger Innovation 🚚✨

Tesla's Semi Truck is changing the game in freight transport. Imagine big rigs gliding silently down the highway, with no emissions! This electric beast promises lower running costs and could reshape the logistics industry.

3. Cybertruck: The Pickup of Tomorrow 🤖🚚

The Cybertruck looks like it rolled out of a sci-fi movie. With its unique, angular design and tough exterior, this all-electric pickup is not just about looks. It's built to be durable, powerful, and has the kind of performance that'll make you go "Wow!"

4. Supercharger: Power Up, Fast! ⚡🔋

Tesla's Supercharger network is like a lifeline for EVs. These fast-charging stations let Tesla drivers juice up their cars in minutes, not hours. It's about making electric travel as convenient as possible. Road trip, anyone?

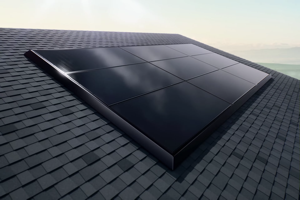

5. Solar Roof: Your Home, The Power Plant ☀️🏡

Tesla's Solar Roof takes solar energy to the next level. These are not just solar panels; they're beautifully designed tiles that turn your home into a power generator. They're sleek, durable, and a smart investment for a greener future.

6. Power Panel: Catch the Sun! 🌞

Tesla's Power Panels bring traditional solar energy home. They're efficient, reliable, and a step towards sustainable living. Imagine reducing your electric bill while helping the planet!

7. Powerwall: Store Your Sunshine 🔋☀️

The Powerwall is Tesla's answer to energy storage. This home battery stores solar energy, so you can use it whenever you need it, day or night. It's like having a personal energy reserve!

8. Optimus: The Robot of Tomorrow 🤖🌟

Meet Optimus, Tesla's venture into robotics. While still under wraps, this humanoid robot represents Tesla's leap into artificial intelligence. It's not just about cars and energy; Tesla is looking to shape the future in exciting new ways!

Tesla's Competitive Edge 💪

Let's explore three key competitive advantages that make Tesla a standout in the stock market.

1. Innovation is the Name of the Game 🧠⚡

Tesla is like that smart kid in class who's always ahead of the curve. Their innovation game is strong, and it's not just about fancy electric cars. Tesla is a tech powerhouse, constantly pushing boundaries in areas like battery technology, autonomous driving, and renewable energy solutions. This isn't just about going from A to B; it's about reshaping how we think about transportation and energy.

2. Brand Power: More Than Just a Logo 🌟🚘

When you think Tesla, you think cool, right? Tesla's brand is synonymous with cutting-edge, eco-friendly, and high-performance. It's not just a car; it's a statement. This brand power goes a long way in attracting customers and maintaining a loyal fan base.

3. Musk's Magic Touch ✨👨🚀

Last but definitely not least, let's talk about Elon Musk, Tesla's charismatic leader. He's like the rockstar of the tech world, and his vision and leadership have been pivotal in Tesla's journey. From ambitious goals to groundbreaking launches, Musk's influence is a major draw for investors. His ability to dream big and then make those dreams a reality is a rare quality that sets Tesla apart in a crowded market. 🌌🚀

Is CEO Competent and Honest? 👨💼👩💼

We're zooming in on a figure who's as fascinating as he is influential in the world of tech and business – Elon Musk, the CEO of Tesla.

1. The Maverick Leader: Elon Musk 🌟

Elon Musk isn't just any CEO; he's a bit like a superhero from a sci-fi novel. Known for his role in creating not just Tesla, but also SpaceX, Musk is a figure of immense curiosity and intrigue in the tech world.

2. A Record of Innovation 🧠✨

Under his leadership, Tesla has revolutionized the electric vehicle market. He's a big-picture thinker, always pushing boundaries, whether it's making electric cars mainstream or shooting cars into space (literally!). His competence in driving innovation and turning ambitious ideas into reality is clear. 🌌🚘

3. Honesty and Transparency: A Mixed Bag 🤔💬

When it comes to honesty, Musk is a bit of a mixed bag. He's known for being outspoken and sometimes controversial on social media. This transparency can be refreshing, but it also raises eyebrows at times. Musk's tweets have stirred up markets and even gotten him into trouble with regulators. So, while his honesty isn't in question, his way of communicating sometimes blurs the lines between personal expression and professional discretion. 📱🔄

4. Resilience and Commitment 💪🚀

Musk's journey hasn't been a smooth ride. He's faced setbacks, from production challenges at Tesla to rocket explosions at SpaceX. But his resilience and commitment to his vision are undeniable. He's shown time and again that he's not just in it for the short haul.

Tesla's Mission 🌍

Understanding Tesla's mission can help us see beyond the stock prices and into the soul of the company.

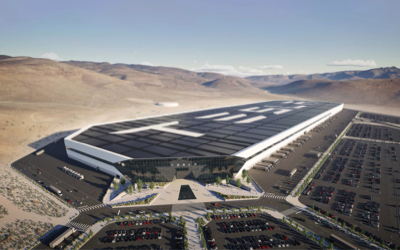

1. Charged with Sustainability ⚡🌱

At its core, Tesla's mission is simple yet profound: "To accelerate the world's transition to sustainable energy." This isn't just about making cars; it's about reshaping our energy consumption. Tesla's pushing the envelope not only with electric vehicles but also through solar energy and battery storage solutions.

2. Drive Innovation 🚀

Tesla is synonymous with innovation, and this is deeply ingrained in their DNA. They're constantly questioning the status quo, pushing boundaries to make technology smarter, safer, and more efficient. But it's not just about being high-tech. Tesla's commitment to sustainability is reflected in their relentless pursuit of energy-efficient solutions.

Stock Prices and Returns 📈

As of 2024-10-26, the 5-year average annual stock return for Tesla is 73.6%. The stock price has surged dramatically so far. Below is a chart showing the current stock price of Tesla.

Dividends 💰

Currently, Tesla is not paying any dividends.

Financial Statements 📊

Let's dive into the financial statements, the 'report card' of a company. They're key to understanding its growth and figuring out if it's a smart investment choice. Join me in this exploration!

1. Revenue 🏦

Revenue is the total amount of money a company earns from selling its products. The annual revenue growth rate over the past year for Tesla is 1.37%. Additionally, the average annual revenue growth rate over 5 years is 30.71%. You can see that the revenue of Tesla has been growing in the long term.

2. Net Income💰

Net income refers to the amount a company makes after subtracting the costs of goods sold from its sales revenue. Over the past year, the net income of Tesla has 1.57%, indicating a growth 📈.

Meanwhile, the average annual net income over 5 years has been 83.45%, showing a growth trend. Don't forget that the increase in net profit becomes the ultimate performance indicator for a company.

3. Debt 💳

The debt-to-equity ratio of Tesla is 12%. This means that Tesla has less debt than equity, indicating sound debt management. Furthermore, when examining the debt ratio compared to net income, it stands at 45.72%. Even when compared to the annual net income, it can be said that Tesla has a relatively low amount of debt.

4. ROIC (Return on Invested Capital)💰

ROIC is a measure of how much net income a company earns with the capital it has at its disposal. The current ROIC of Tesla is 11.56%. The ROIC of Tesla is impressively high, indicating that it is generating high efficiency net income with limited capital. Meanwhile, the average ROIC over the last 5 years is 14.18%.

5. PER (Price to Earnings Ratio) 📊

The PER is an indicator that allows you to see how much the stock price is valued in relation to net earnings. A higher PER indicates that the stock price is overvalued. The current PER of Tesla is 75.62. Also, the 5-year average PER is 130.04. Since the current PER is lower than the average, it suggests that the stock is undervalued compared to usual.

Meanwhile, the Forward PER predicted by analysts is 78.74. As worse performance is expected than current, there's a possibility that the stock price might fall.

6. PSR (Price/Sales Ratio) 📊

The PSR is an indicator that helps determine how high the stock price is in relation to the sales revenue. A higher PSR indicates that the stock price is considered overvalued. The current PSR of Tesla is 8.99. Also, the 5-year average PSR is 9.90. Since the current PSR value is lower than the average, it suggests that the stock is undervalued compared to normal.

7. Share Buyback 🔄

Currently, Tesla is not engaging in stock buybacks .

Advantages of Investing in Tesla 🌟

Let's explore why investing in Tesla stocks could be more attractive compared to other stocks.

1. Innovation at the Forefront 🌟

Tesla isn't just a car company; it's a trendsetter in the world of technology and sustainable energy. They're constantly pushing boundaries, whether it's through electric vehicles (EVs) or solar energy products. This innovation drive makes Tesla not just a car manufacturer but a key player in the future of energy and transportation. Think about it - investing in Tesla is like investing in a piece of the future! 🌍✨

2. Strong Brand Recognition 🏆

Let's face it, almost everyone knows about Tesla. This popularity isn't just good for their car sales, but it's great for investors too. A strong brand can translate into customer loyalty and consistent sales, which is music to any investor's ears. 🎶🚗

3. Leader in the EV Market 🚘

Tesla is a major player in the electric vehicle market. With concerns about climate change growing, more people are looking to switch to eco-friendly cars. Tesla, being a pioneer in this space, is perfectly positioned to capitalize on this trend. Plus, with governments around the world pushing for greener initiatives, Tesla's market could grow even bigger. 🌱🔋

4. Cutting-Edge Technology 🤖

From self-driving capabilities to innovative battery technology, Tesla is always a step ahead. Their technology isn't just cool; it's groundbreaking. As they continue to develop and improve their tech, Tesla could revolutionize not just the auto industry but multiple sectors. It's like investing in a tech company and a car company at the same time! 🚗💻

5. Robust Financial Performance 💰

Tesla has shown strong financial growth over the years. With increasing sales, expanding global presence, and new models in the pipeline, their financial health looks promising. For investors, this growth potential is definitely appealing. 💹📈

Disadvantages of Investing in Tesla ⚠️

Investing in Tesla, like any stock, comes with its own set of risks and rewards.

1. Understanding the Volatility 🎢

Tesla's stock price can be a roller coaster ride. The company's innovative nature and headline-grabbing news can lead to big swings in stock prices. This can be thrilling but also a bit scary, especially for those who prefer a steadier investment.

2. The Elon Musk Factor 🚀

Elon Musk is a visionary and a major reason behind Tesla's success. But his high profile and frequent tweets can impact Tesla's stock, sometimes in unpredictable ways. Remember, investing in Tesla is, in a way, investing in Musk's vision and leadership style.

3. Competition is Heating Up 🔥

Tesla may be a leader in electric vehicles, but it's no longer the only player in town. Other major automakers are ramping up their EV game, which could challenge Tesla's market dominance. More competition might mean Tesla has to work harder to stay ahead.

4. Regulatory and Political Sensitivity 🌍

Tesla's business is closely tied to environmental policies and government incentives for clean energy. Changes in government policies or economic incentives can impact Tesla's performance. It's important to keep an eye on the political and regulatory landscape.

5. High Expectations, High Pressure 📈

Tesla's stock price often reflects sky-high expectations for its future growth. This means the company needs to continually deliver impressive results to justify its stock price. Any slip in performance or missed targets can lead to significant stock price movements.

6. Battery Technology and Supply Chain Challenges 🔋

Tesla's success relies heavily on advances in battery technology and a smooth supply chain. Any issues in these areas, like shortages of raw materials or production delays, can impact the company's ability to meet demand and its overall profitability.

Tesla's Competitors 🏆

Here are noteworthy companies that are competing with Tesla.

1. General Motors (GM) 🚗

GM, a traditional automotive giant, has made significant strides in the EV market. They've committed to an all-electric future, with plans to launch several new electric models in the coming years.

Investing in GM offers a blend of traditional auto industry stability and a growing presence in the EV space.

2. Ford Motor Company 🏎️

Similar to GM, Ford is an established player in the automobile industry, now pivoting towards electrification. Their Mustang Mach-E and the electric version of the popular F-150 truck, the F-150 Lightning, are direct competitors to Tesla’s lineup. Ford’s strong brand and vast dealership network could give it an edge in the EV market.

3. NIO 🇨🇳

A Chinese electric vehicle manufacturer, NIO is often touted as the 'Tesla of China.' It's known for its innovative battery-swapping technology and has been rapidly growing in the Chinese EV market. Investing in NIO can be seen as a bet on the growth of the EV market in China, the largest auto market in the world.

4. Volkswagen Group 🚘

Volkswagen, one of the world's largest automakers, is aggressively pursuing electrification. With a broad range of electric models and significant investments in battery technology and production, Volkswagen is a major global competitor to Tesla in the EV race.

5. Lucid Motors 🌟

A newer entrant to the EV market, Lucid Motors focuses on luxury electric vehicles. Their first car, the Lucid Air, has received accolades for its range and performance, positioning Lucid as a direct competitor to Tesla in the high-end EV segment.