Long-term Investing in Qualcomm Stock: Products, Dividend, Financial Statements, and More

Today, we're shining the spotlight on Qualcomm, a giant in the world of wireless technology. 🌐 Known for powering a vast array of mobile devices with its innovative chipsets, Qualcomm is a key player in the tech world. 📱🚀

Contents

Products and Services 🔍

Understanding these products is key to getting a grasp on Qualcomm's potential in the stock market.

1. Snapdragon Processors: The Heart of Your Smartphone 📱❤️

First up, let's talk about Snapdragon Processors. These little geniuses are the beating heart in many smartphones and tablets. Think of them as the brains of the operation, handling everything from your Instagram scrolls to those endless Candy Crush sessions. They're known for being super speedy and battery-friendly, which is why everyone from Samsung to Google loves them.

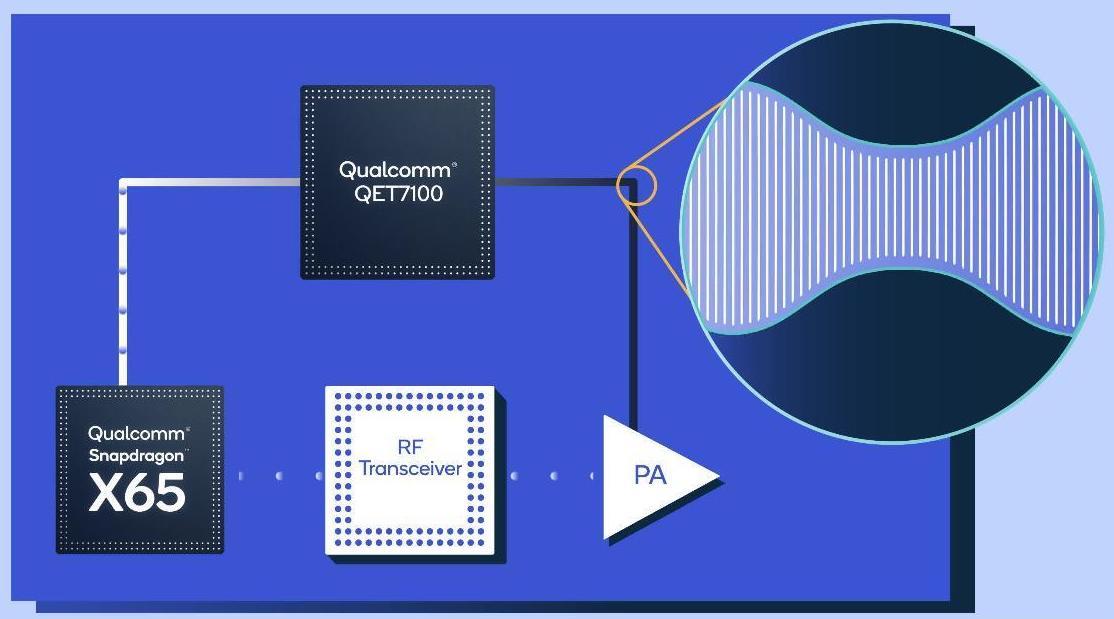

2. 5G Technology: The Fast Lane of the Internet 🌍💨

Next, let's zoom into 5G Technology. Qualcomm is like a 5G wizard, crafting the magic that makes our internet faster and more reliable. This tech is not just about speed; it's about connecting more devices efficiently and revolutionizing industries from gaming to healthcare.

3. Wi-Fi Solutions: Keeping You Connected 🌐🔗

On to Wi-Fi Solutions! Qualcomm is big on making Wi-Fi faster, more reliable, and ready for the future. They're all about Wi-Fi 6 – the latest in Wi-Fi tech. It means smoother Netflix streaming and zippier file downloads. 💻📶

4. Quick Charge Technology: Power Up, Fast! ⚡🔋

Now, let's energize with Quick Charge Technology. Ever got frustrated with slow phone charging? Qualcomm's Quick Charge is here to rescue you from the low-battery blues. This tech powers up devices super fast, which is a big plus for us living in the fast lane. 🚗💨

5. Qualcomm AI Engine: Smarter Devices, Smarter Investing 🤖💡

Diving into the Qualcomm AI Engine – this is where things get really smart. This tech is all about making devices think like us (kind of). It improves everything from voice recognition in your phone to those cool camera tricks.

6. RF Front-End Modules: The Unsung Heroes 📡🌍

Lastly, let's shine a light on RF Front-End Modules. These might not sound glamorous, but they're crucial. They make sure your phone can talk to networks without a hiccup, supporting a wide range of frequencies. 🌐

Qualcomm's Competitive Edge 💪

By understanding these advantages, you're better equipped to gauge Qualcomm's potential in your investment journey.

1. Innovation Powerhouse 💡

First up, Qualcomm is like the brainiac in the tech class. They're constantly pushing the boundaries of what's possible. Think of Qualcomm as the mastermind behind the scenes, powering the smartphones and devices we can't live without. 📱 They're always a step ahead in developing new technologies, especially in areas like 5G, which is like the super-fast internet highway of the future.

2. Patent Portfolio Power 📚

Here's where things get even more interesting. Qualcomm doesn't just make great products; they own a treasure trove of patents. These patents are like golden tickets, giving them legal rights to their inventions. It's like owning a recipe for an ultra-popular secret sauce – others can't just copy it without paying.

3. Strong Market Position 🌍

Finally, Qualcomm isn't just another player in the game; they're like the captain of the team. They've got a strong foothold in the market, especially in the smartphone sector. Their chips are in loads of devices, from budget-friendly phones to high-end models.

Is CEO Competent and Honest? 👨💼👩💼

let's zoom in on the man steering the Qualcomm ship – CEO Cristiano Amon. Understanding the leadership behind a company is crucial.

1. Cristiano Amon: A Leader with a Vision 🚀

Cristiano Amon, at the helm of Qualcomm, is not just another corporate figure. He's a leader with a deep understanding of the tech world. Since taking over as CEO, Amon has been a driving force in maintaining Qualcomm's status as a key player in the mobile technology space. 📱

2. The Competence Compass 🧭

When it comes to competence, Amon ticks all the right boxes. He's been with Qualcomm for over two decades, climbing up the ranks and truly understanding the company's ins and outs. This isn't just about sitting in the big chair; it's about knowing the nuts and bolts of the business.

His background in engineering and his experience in various roles within Qualcomm give him a unique perspective. It's like having a captain who not only navigates the ship but also knows how to fix it.

3. Honesty and Transparency: The Open Book Approach 📖

In the world of investing, honesty from a CEO is like finding a diamond in the rough. From what we can see, Amon's approach leans towards transparency. He's known for being straightforward about the company's direction and challenges, which is refreshing.

No leader is perfect, and the tech world is always changing. But Amon's openness about Qualcomm's journey, including the hurdles, shows a level of honesty that's crucial for investor trust.

Qualcomm's Mission 🌍

Understanding a company's mission, values, and management philosophy is key to making informed investment decisions.

1. Connecting the Unconnected 🌍

Qualcomm's mission is all about making the world more connected. Think of them as the digital bridge builders of our time. Their goal? To create technologies that link everyone and everything together. It's not just about phones or tablets; it's about connecting cars, homes, cities, and even things we haven't thought of yet! 🚗🏠🏙️

2. Innovation, Execution, Partnership 🤝

Qualcomm's values are the guiding stars of their journey. At the heart is innovation – they're constantly pushing the envelope, thinking about what's next. But it's not just about great ideas; it's about executing them brilliantly. That's where their second value, execution, comes in. They're all about turning those bright ideas into reality.

The third value, partnership, shows their understanding that no one does it alone. Qualcomm knows that working with others, from big companies to small startups, is key to making their vision come to life. It's like a tech symphony, with Qualcomm conducting the orchestra. 🎼

Stock Prices and Returns 📈

As of 2024-10-26, the 5-year average annual stock return for Qualcomm is 16.54%. The stock has been rising significantly in the long term. Below is a chart showing the current stock price of Qualcomm.

Dividends 💰

As of 2024-10-26, the annual dividend rate of Qualcomm is 2%. Additionally, the dividend growth rate over the past year is 6.13% and the average annual dividend growth rate over 5 years is 6.5%. The dividends have been growing well over the long term.

Financial Statements 📊

Let's dive into the financial statements, the 'report card' of a company. They're key to understanding its growth and figuring out if it's a smart investment choice. Join me in this exploration!

1. Revenue 🏦

Revenue is the total amount of money a company earns from selling its products. The annual revenue growth rate over the past year for Qualcomm is -3.21%. A decrease in revenue over the past year indicates that the company sold fewer products or services compared to last year, which isn't a good sign. Additionally, the average annual revenue growth rate over 5 years is 12.74%. You can see that the revenue of Qualcomm has been growing in the long term.

2. Net Income💰

Net income refers to the amount a company makes after subtracting the costs of goods sold from its sales revenue. Over the past year, the net income of Qualcomm has 1.13%, indicating a growth 📈.

Meanwhile, the average annual net income over 5 years has been 21.01%, showing a growth trend. Don't forget that the increase in net profit becomes the ultimate performance indicator for a company.

3. Debt 💳

The debt-to-equity ratio of Qualcomm is 59%. This means that Qualcomm has less debt than equity, indicating sound debt management. Furthermore, when examining the debt ratio compared to net income, it stands at 174.06%. Even when compared to the annual net income, it can be said that Qualcomm has a relatively low amount of debt.

4. ROIC (Return on Invested Capital)💰

ROIC is a measure of how much net income a company earns with the capital it has at its disposal. The current ROIC of Qualcomm is 25.96%. The ROIC of Qualcomm is impressively high, indicating that it is generating high efficiency net income with limited capital. Meanwhile, the average ROIC over the last 5 years is 23.33%.

5. PER (Price to Earnings Ratio) 📊

The PER is an indicator that allows you to see how much the stock price is valued in relation to net earnings. A higher PER indicates that the stock price is overvalued. The current PER of Qualcomm is 22.08. Also, the 5-year average PER is 20.02. Since the current PER is higher than the average, it suggests that the stock is overvalued compared to usual.

Meanwhile, the Forward PER predicted by analysts is 15.15. As better performance is expected than current, there's a possibility that the stock price might rise.

6. PSR (Price/Sales Ratio) 📊

The PSR is an indicator that helps determine how high the stock price is in relation to the sales revenue. A higher PSR indicates that the stock price is considered overvalued. The current PSR of Qualcomm is 5.10. Also, the 5-year average PSR is 4.64. Since the current PSR value is higher than the average, it suggests that the stock is overvalued compared to normal.

7. Share Buyback 🔄

Over the past year, the company has repurchased 2.37% of its total equity, acquiring these shares as treasury stock. The amount of treasury shares repurchased has risen compared to the three-year average. If Qualcomm decides to retire these treasury shares, it could lead to shareholder value return, potentially having a positive impact on the stock price.

Advantages of Investing in Qualcomm 🌟

Let's chat about Qualcomm, a big name in the tech world, and why its stocks might just be the savvy choice you're looking for.

1. Leading the 5G Revolution 📶

First off, Qualcomm is at the forefront of the 5G revolution. This isn't just about faster phones; it's about powering a whole new world of connected devices, from cars to smart home gadgets. With 5G, we're talking about a game-changer in how we live and work, and Qualcomm is leading the charge. 🌐

Why is this great for investors? Well, as 5G technology becomes more widespread, Qualcomm's chips and patents are going to be in high demand. This means potential growth in their market share and, by extension, a potential uptick in the value of their stocks. It's like catching the wave right as it's starting to rise! 🌊

2. A Portfolio of Patents 📚

Here's where things get really interesting. Qualcomm isn't just about making chips; they own a massive portfolio of patents. These patents are like golden tickets in the tech world, and they put Qualcomm in a powerful position. They earn from licensing these patents, creating a steady stream of income. 💰

For you, as an investor, this is a big deal. This steady income can provide some stability to Qualcomm's financials, making it a potentially less volatile option compared to other tech stocks. It's like having a rock in your investment garden that's less likely to be shaken by market winds. 🌬️🪨

3. Diverse Applications: Beyond Just Smartphones 📱➡️🌍

Lastly, Qualcomm's tech isn't limited to smartphones. They're delving into areas like automotive, IoT (Internet of Things), and even AI. This diversification means they're not putting all their eggs in one basket, reducing the risk that comes with relying on a single market sector. 🚗🏠🤖

Disadvantages of Investing in Qualcomm ⚠️

Knowing the risks is just as crucial as knowing the benefits, right?

1. Market Competition: A Tech Tug-of-War 🤼♂️

First up, Qualcomm is in a highly competitive market. This isn't a leisurely walk in the park; it's more like a high-stakes race. They're up against other big names in the tech world, each vying to be the top dog in areas like 5G, semiconductors, and mobile tech.

2. Legal and Regulatory Hurdles: Navigating the Legal Maze 🏛️

Qualcomm has faced its fair share of legal and regulatory challenges. From antitrust allegations to patent disputes, these legal battles can be a bit of a headache.

For investors, this is like a caution sign on the road. Legal issues can lead to financial penalties, affect business operations, and even tarnish the company's reputation.

3. Technology Reliance: All Eggs in One Basket? 🥚

Lastly, Qualcomm's success is heavily tied to the tech sector, particularly smartphones and emerging tech like 5G and IoT. While this focus has its advantages, it also means their fortunes are closely linked to the health of the tech industry.

Qualcomm's Competitors 🏆

Knowing the competition is key to making smart investment decisions.

Think of Intel as the grandmaster of computer processors. They've been around since the dawn of the digital age, and you've likely seen their stickers on laptops and PCs. But it's not just about computers; Intel's dipping its toes in mobile technology and communications, stepping into Qualcomm's turf.

NVIDIA is the superstar of graphics processing. If you're into gaming or anything with stunning visuals, you've probably heard of them. But there's more! NVIDIA's also venturing into mobile processors and AI technology, areas Qualcomm knows quite well.

Broadcom might not be a household name, but in the tech world, they're a big deal. Specializing in semiconductors and infrastructure software, Broadcom competes with Qualcomm in wireless communication. 📡🌍

Texas Instruments, or TI, isn't just about those calculators we used in school. They're major players in the semiconductor game, with a hand in everything from wireless communication to mobile computing. 🔧

Last but not least, AMD is the rising star in the semiconductor world. Known for their CPUs and GPUs, they're stepping up to compete with Qualcomm in the mobile and wireless space.