Long-term Investing in Oracle Stock: Products, Dividend, Financial Statements, and More

🚀 Ready to explore the world of tech giants in the stock market? 📈 Meet Oracle, a powerhouse in database software and technology services, renowned for revolutionizing how businesses operate.

Contents

Products and Services 🔍

Knowing Oracle's main products can really help with your investment decisions!

1. Oracle Database: The Data Dynamo 💾

Hey there! Imagine having a digital brain that can store, organize, and manage all the data your business could ever produce. That's Oracle Database for you - the backbone of countless businesses, handling everything from small data to big, complex datasets with ease.

2. Oracle Cloud Infrastructure (OCI): Your Cloud Powerhouse ☁️

Next stop, the cloud! OCI is like a virtual LEGO set for techies, offering all the building blocks (like servers and storage) needed to construct your dream online infrastructure. It's where companies go to play when they want to scale up, speed up, and smarten up their operations in the cloud. 🌩️

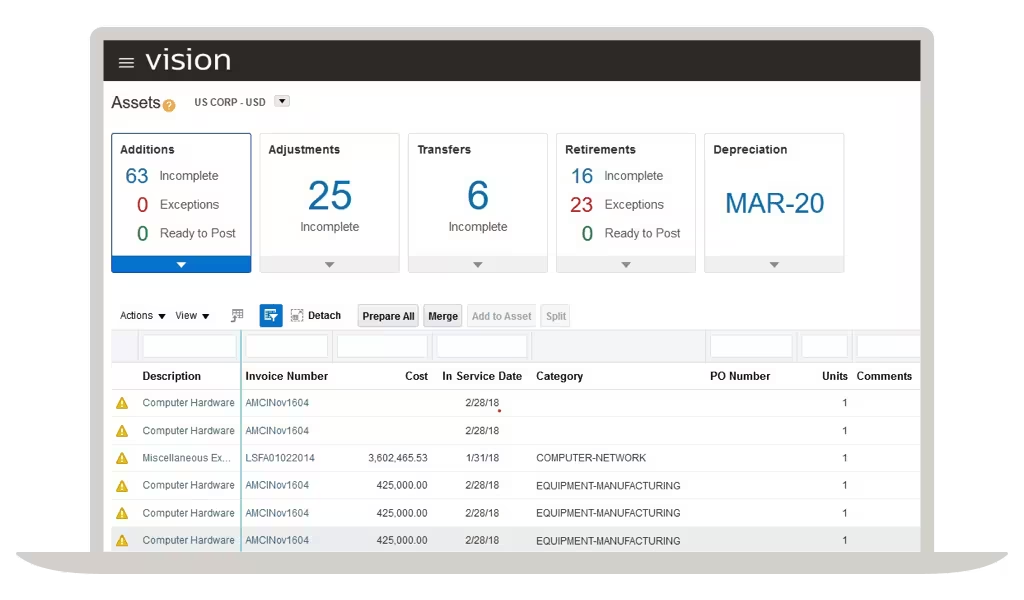

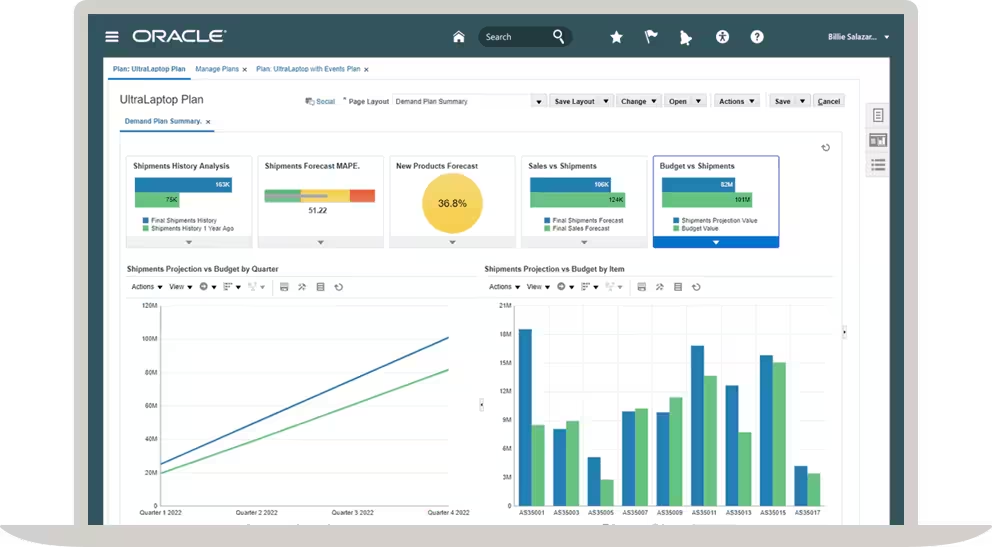

3. Oracle Enterprise Resource Planning (ERP) Cloud: The Business Brainiac 🧠

Calling all business buffs! Oracle's ERP Cloud is like having a super-smart assistant who knows everything about your business's financials, project management, and procurement. It's all about making complex business processes smoother, smarter, and more synchronized. 📊

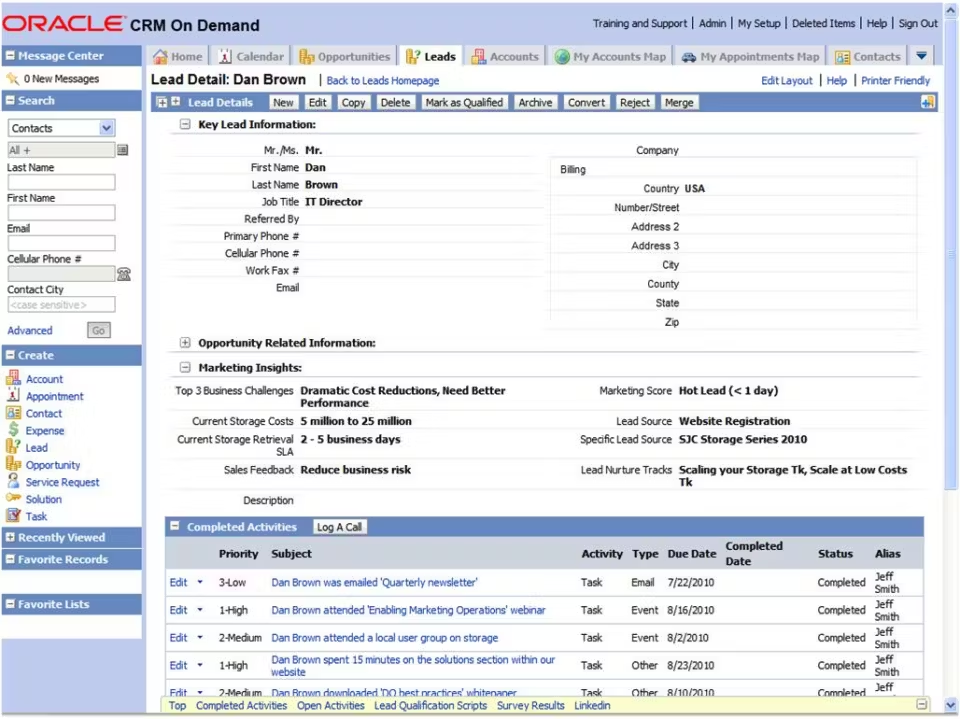

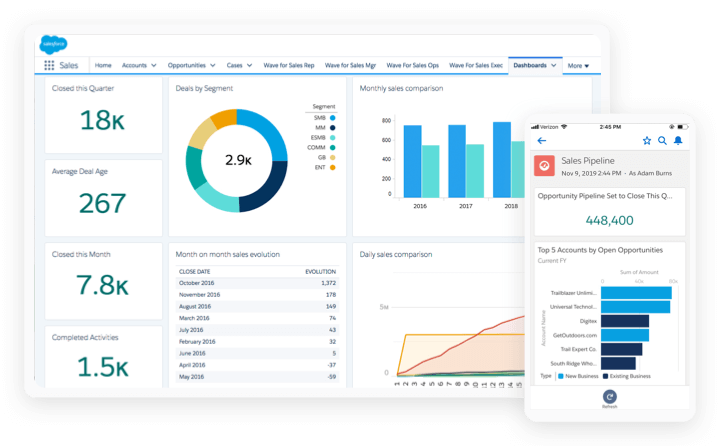

4. Oracle Customer Relationship Management (CRM): Your Customer Champion 🏆

Customer lovers, unite! Oracle CRM is all about understanding and connecting with customers. Imagine a tool that helps you track customer interactions, analyze their needs, and create stronger relationships.

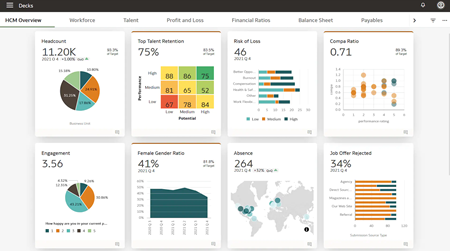

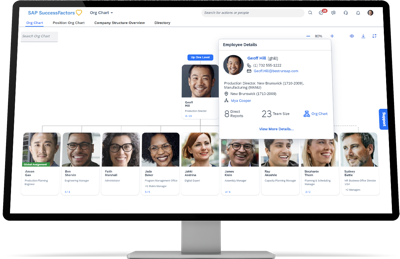

5. Oracle Human Capital Management (HCM) Cloud: The People's Partner 👥

Human resources, but cooler. Oracle's HCM Cloud is like a high-tech HR department in the cloud, managing everything from hiring to retirement. It's where technology meets humanity, helping businesses manage their most valuable asset - their people. 👔

6. Oracle Supply Chain Management (SCM) Cloud: The Supply Chain Superstar 🌐

Supply chain enthusiasts, gather around! Imagine having a bird's eye view of your entire supply chain. That's what Oracle SCM Cloud does. It's all about managing the flow of goods, money, and information in the most efficient way possible. 📦

7. Java: The Programming Power Player ☕

Java is not the coffee, but almost as energizing. This programming language is everywhere - from your favorite websites to mobile apps. Acquired by Oracle, Java is like the universal language of the tech world, making digital dreams come true. 🌍

Oracle's Competitive Edge 💪

Understanding what sets Oracle apart is key to making informed investment decisions.

1. Technological Titan: Innovation at Its Core 🔧

First up, innovation! Oracle isn't just playing the tech game; it's ahead of the curve. 🌐 With a history rich in tech advancements, Oracle leads with its top-notch database technology and cloud solutions. It’s like the tech wizard of the corporate world, constantly conjuring up new and improved ways to handle data and computing needs.

2. Trusted by the Titans: A Customer Base That Speaks Volumes 📣

Next, let’s talk about trust. Oracle’s customer list reads like a who's who of the global business world. 🌍 Big names across various industries rely on Oracle’s products, from finance to healthcare. This isn't just about having famous clients; it's a testament to Oracle's reliability and the quality of its solutions. 🤝

3. Financial Fortress: Stability and Strength 💰

Last but certainly not least, financial robustness. Oracle isn't just surviving; it's thriving. 💹 With a solid financial foundation, including consistent revenue growth and strong profit margins, Oracle stands as a financial fortress. This financial health is crucial for weathering market storms and investing in future growth.

Is Leader Competent and Honest? 👨💼👩💼

we're taking a closer look at a key figure in the tech world – Larry Ellison, the Chairman of Oracle. Understanding the captain steering the ship is crucial in your investment journey

1. The Oracle Visionary: Larry Ellison's Journey 🌌

So, who is Larry Ellison? Picture a tech enthusiast, a brilliant mind, and a daring entrepreneur all rolled into one – that's Larry for you! 🧠 He co-founded Oracle in 1977 and has been a driving force behind its rise to a tech giant. Ellison is known for his sharp business acumen and innovative vision.

2. More Than Just a Leader: Competence and Leadership 🏆

But is he competent and honest? Good question! Under Ellison’s leadership, Oracle transformed from a database software company into a cloud computing trailblazer. This shift wasn’t just smart; it was visionary. 🌤️ As for honesty, Ellison's approach has always been straightforward and transparent, focusing on long-term growth over short-term gains.

3. The Ellison Effect: Impact on Oracle 🌐

What's his impact on Oracle? Well, imagine someone who’s not just running a company but constantly pushing it to innovate and excel. That’s Larry Ellison. His leadership style blends bold decisions with a deep understanding of technology and market needs.

Oracle's Mission 🌍

Understanding what drives this tech behemoth is key to seeing the bigger picture and making informed long-term investment decisions.

1. Innovation and Transformation 🌐

What's Oracle all about? At its heart, Oracle’s mission is to help people see data in new ways, discover insights, and unlock endless possibilities. 🌟 Think of Oracle as a tech wizard, constantly innovating to transform how businesses operate and grow. Whether it’s through their cloud solutions, database technologies, or software applications, Oracle is all about empowering organizations to harness the full power of their data.

2. The Oracle Compass 🧭

Oracle’s core values are like its compass, guiding every decision and innovation. 🧭 They focus on customer success, restlessly seeking to understand customer challenges and delivering solutions that meet and often exceed their needs. It's not just about selling products; it’s about building relationships and ensuring customer victories.

Stock Prices and Returns 📈

As of 2024-10-26, the 5-year average annual stock return for Oracle is 26.02%. The stock price has surged dramatically so far. Below is a chart showing the current stock price of Oracle.

Dividends 💰

As of 2024-10-26, the annual dividend rate of Oracle is 0.92%. The current dividend rate is low. Additionally, the dividend growth rate over the past year is 24.92% and the average annual dividend growth rate over 5 years is 10.74%. The dividends have been growing well over the long term.

Financial Statements 📊

Let's dive into the financial statements, the 'report card' of a company. They're key to understanding its growth and figuring out if it's a smart investment choice.

1. Revenue 🏦

Revenue is the total amount of money a company earns from selling its products. The annual revenue growth rate over the past year for Oracle is 5.58%. Additionally, the average annual revenue growth rate over 5 years is 6.36%. You can see that the revenue of Oracle has been growing in the long term.

2. Net Income💰

Net income refers to the amount a company makes after subtracting the costs of goods sold from its sales revenue. Over the past year, the net income of Oracle has 17.03%, indicating a growth 📈.

Meanwhile, the average annual net income over 5 years has been 0.04%, showing a growth trend. Don't forget that the increase in net profit becomes the ultimate performance indicator for a company.

3. Debt 💳

The debt-to-equity ratio of Oracle is 781%. Furthermore, when examining the debt ratio compared to net income, it stands at 792.91%. In comparison to the annual net income, Oracle has a significant amount of debt.

4. ROIC (Return on Invested Capital)💰

ROIC is a measure of how much net income a company earns with the capital it has at its disposal. The current ROIC of Oracle is 11.3%. The ROIC of Oracle is impressively high, indicating that it is generating high efficiency net income with limited capital. Meanwhile, the average ROIC over the last 5 years is 12.21%.

5. PER (Price to Earnings Ratio) 📊

The PER is an indicator that allows you to see how much the stock price is valued in relation to net earnings. A higher PER indicates that the stock price is overvalued. The current PER of Oracle is 44.94. Also, the 5-year average PER is 29.72. Since the current PER is higher than the average, it suggests that the stock is overvalued compared to usual.

Meanwhile, the Forward PER predicted by analysts is 28.01. As better performance is expected than current, there's a possibility that the stock price might rise.

6. PSR (Price/Sales Ratio) 📊

The PSR is an indicator that helps determine how high the stock price is in relation to the sales revenue. A higher PSR indicates that the stock price is considered overvalued. The current PSR of Oracle is 8.98. Also, the 5-year average PSR is 5.95. Since the current PSR value is higher than the average, it suggests that the stock is overvalued compared to normal.

7. Share Buyback 🔄

Over the past year, the company has repurchased 0.12% of its total equity, acquiring these shares as treasury stock. If Oracle decides to retire these treasury shares, it could lead to shareholder value return, potentially having a positive impact on the stock price.

Advantages of Investing in Oracle 🌟

Investing can be a maze, but understanding the unique strengths of Oracle stocks can help light the way.

1. Steady as She Goes: Financial Stability 💰

Firstly, financial stability! Oracle isn't just another player in the tech game; it's more like a seasoned pro. With consistent revenue and profit margins, investing in Oracle can be like adding a sturdy anchor to your portfolio. It's the financial equivalent of a reliable, trustworthy friend. 🤝

2. Innovation: The Never-Ending Journey 🚀

Next up, innovation! Oracle is a bit like a tech wizard, always cooking up something new in its innovation cauldron. From cloud computing to database solutions, they're not just keeping up with tech trends; they're leading them. Investing in Oracle is like riding the wave of tech's future. 🌊

3. Diverse Product Portfolio: A Buffet of Options 🍱

Variety is the spice of life, and Oracle's diverse product portfolio proves just that. With a range spanning from cloud services to software solutions, Oracle’s wide array of offerings means they're not putting all their eggs in one basket - and neither are you as an investor.

4. Global Presence: A Worldwide Play 🌍

Think global! Oracle's global footprint is impressive, with operations and customers spread across the world. This international presence not only diversifies risk but also opens up a world of opportunities. Investing in Oracle is like having a VIP ticket to the global tech show. ✈️

5. Strong Leadership: Guiding the Ship 🧭

Last but not least, leadership! With visionaries like Larry Ellison at the helm, Oracle's leadership has a proven track record of steering the company through tech's choppy waters. Strong leadership can be a reassuring sign that the company is in capable hands. It's like having a seasoned captain for your investment voyage. ⚓

Disadvantages of Investing in Oracle ⚠️

Let’s chat about some potential disadvantages and caveats to keep in mind.

1. Intense Competition: The Tech Battlefield 🤺

First on our list, competition. The tech industry is like a high-stakes game of chess, and Oracle is up against some heavyweight contenders like Amazon and Microsoft, especially in cloud services. This intense competition means Oracle needs to continuously innovate and invest to stay ahead. It's a bit like running a never-ending race. 🏃♂️

2. Market Volatility: Riding the Tech Waves 🌊

Next, market volatility. Tech stocks, Oracle included, can be a rollercoaster ride. With rapid changes in technology and market preferences, stock prices might fluctuate more than your average stock. It’s like surfing – exhilarating but unpredictable. 🏄

3. Slow Transition to Cloud: Catching Up 🐢

Now, let’s talk about cloud transition. Oracle has been moving towards cloud computing, but it's a bit like turning a large ship – it takes time. They're catching up in a race where others had a head start. This slower transition could impact short-term growth prospects. Patience is key here. ⏳

4. Dependence on Legacy Products: Old School Ties 📚

Also, don't forget legacy dependence. A large chunk of Oracle's revenue still comes from traditional software licensing. While this isn't bad per se, it does mean that Oracle is still transitioning from its old-school roots to newer, cloud-based models.

5. Leadership Dynamics: A Double-Edged Sword ⚔️

Lastly, leadership dynamics. While strong leadership under Larry Ellison has been a boon, it also means that Oracle's fortunes are closely tied to its leadership strategies. This can be a double-edged sword, where decisions made at the top have significant impacts – for better or worse. Think of it as having a powerful engine driving the train – great when on track, but risky if it goes off-rails. 🚂

Oracle's Competitors 🏆

Understanding main competitors is crucial for anyone considering investing in Oracle.

First up, Microsoft! Imagine a tech empire that's been around since the dawn of personal computing. That's Microsoft for you. Their Azure cloud platform is like a Swiss Army knife for businesses, offering everything from cloud hosting to AI services.

Next, let's talk about AWS. Picture a giant warehouse, but instead of goods, it's filled with cloud computing power. That’s Amazon Web Services! They're a titan in the cloud services market, offering an array of tools and services that make them a fierce competitor to Oracle's cloud solutions.

SAP SE: The Business Software Maestro 🎼

Moving on to SAP. Think of an orchestra conductor, but for business software. SAP specializes in enterprise resource planning (ERP) software, orchestrating the flow of business processes with precision. They offer a suite of applications that rival Oracle’s ERP solutions, playing a critical tune in the world of business software. 🎵

Here comes Salesforce! Imagine a magnet that attracts and keeps customers. That's what Salesforce does with its CRM (customer relationship management) software. Their cloud-based solutions are all about helping businesses connect with customers, a direct challenge to Oracle's CRM offerings. They're like the friend-makers of the business world. 👥

Last but not least, IBM. Picture a veteran athlete who's played every game in the tech sports arena. IBM's portfolio spans cloud computing, AI, and enterprise software, making them a versatile player in the tech field. Their diverse technology solutions put them in direct competition with various aspects of Oracle's business.