Invest Well in Logitech Stock: Products, Dividend, Financial Statements, and More

When making long-term investments to ensure stability through diversified investments, it is recommended to prioritize ETFs that include Logitech stocks. However, there might still be individuals who wish to invest directly in Logitech stocks. Shall we also explore a value investing approach to assess whether Logitech's performance will grow in the long term?

Q. What products and services does Logitech provide?

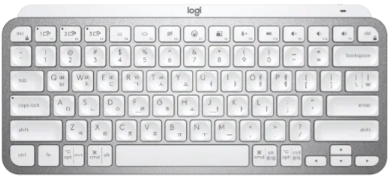

Logitech is an international Swiss company specializing in computer peripherals and consumer electronics. They manufacture a wide range of peripheral devices and consumer electronics, including computer mice like the Mx Anywhere, keyboards like the Mx Keys, webcams like the Streamcam, speakers, headsets, and various other peripherals.

- Mouse: Logitech develops mice with various designs and functionalities.

- Keyboard: Logitech develops keyboards with various designs and functionalities.

- Webcam: Logitech develops webcams for high-quality video calls and streaming.

- Headset and microphone: Logitech develops a variety of headsets and microphones for business, gaming, and music listening.

- Speakers: Logitech develops speakers for business, gaming and music listening purposes.

Q. What is Logitech's competitive advantage?

- Innovation: Logitech actively introduces innovative technology into its products.

- User-Centric Design: Logitech prioritizes user experience in product design, providing consumers with products that are both user-friendly and efficient through simple yet effective design.

- Reliability: Logitech strives to provide reliable products to enhance its brand reputation and maintain long-term relationships.

Q. Is Logitech's executive CEO honest and competent?

- She was appointed CEO on December 1, 2023.

- She has worked at Unilever, Ahold Delhaize, and Procter & Gamble.

- She has over 30 years of experience in consumer, B2B, and e-commerce businesses.

Q. What mission does Logitech have for its work?

Logitech is conducting its business with the direction of designing a positive future.

- Climate Positivity: Logitech's operations and entire product portfolio have received carbon neutrality certification, paving the way for Logitech to remove more carbon than it produces and contribute to a climate-positive future.

- Circularity: Logitech is transitioning to materials with high circularity and actively seeking new ways to reduce waste, while also extending the lifespan of products, components, and materials.

- Inclusive World: Logitech raises awareness about those who work for diversity, equity, inclusivity, and social justice within the community and forms partnerships to promote these values in the world.

- Sustainability: Logitech's mission is to support everyone in pursuing their passions in ways that benefit society and the environment. This influence extends to all design decisions Logitech makes, from materials and packaging to individual customer experiences.

- Carbon Transparency: Carbon is just like calories; we all need to know what we're consuming. Logitech supports making better purchasing decisions by clearly displaying the carbon impact of its products.

- Diversity: Logitech creates the necessary foundation to foster diverse experiences that allow everyone to pursue their passions, reflecting the diversity of the world.

- LOGICARES: Logitech is dedicated to giving back to the local communities where we live, coming together to help these communities thrive and create a positive social and environmental impact.

- Community Support: In times of disasters, Logitech provides support to local communities and collaborates with other companies to expand projects in response to the needs of the community.

Q. Is Logitech's financial statements healthy?

Net Profit Margin

- Logitech has earned an annual net profit equivalent to 2.70% of the current stock price.

- It's good to see that the net profit has been growing at an annual rate of 11.81% over the past 5 years.

Dividend

- Logitech offers a 1.35% annual dividend.

- Over the past 5 years, the annual average dividend has grown by 9.64%.

- Dividends are growing, which is good.

Share Buyback

- Apple recently repurchased its own shares equivalent to 3.10% of the stock price in the past year.

- The recent share buyback amount is 126.09% higher than the 3-year average.

Q. What is Logitech's stock performance like?

- This year's total return is 63.01%.

- 5-year mean total return is 18.98%.

Q. When is a good time to buy and sell Logitech?

If Logitech is healthy and growing, it will rise in the long run, so it is good to buy in installments even if you think the current stock price is a bit high. On the other hand, if you think that Logitech is no longer healthy in the long run, you can consider selling.

PER

- Current: 39.17

- 5Y Avg: 26.67

- The current value is higher than the average, so be careful when buying. However, purchasing can be considered only if you judge that the company will sustain high long-term growth.

Price/Sale Ratio

- Current: 2.97

- 5Y Avg: 2.57

- Current value is higher than average so be careful when buying. However, purchasing can be considered only if you judge that the company will sustain high long-term growth.