Long-term Investing in IBM Stock: Products, Dividend, Financial Statements, and More

Today, let's dive into the world of IBM, a pioneering tech giant renowned for its innovations in computing, software, and IT services.

Contents

Products and Services 🔍

As you ponder adding this tech giant to your portfolio, understanding their key products and services is crucial.

1. IBM Cloud 🌐

Imagine having an entire tech playground at your fingertips - that's IBM Cloud for you! It's like a Swiss Army knife for businesses, offering everything from basic storage to fancy AI services. Think of it as a one-stop-shop for companies looking to scale up, innovate, or just streamline their operations. Cloud computing is the future, and IBM is riding that wave. 🌊☁️

2. IBM Watson 🤖

Ever wished for a super-smart assistant? Meet IBM Watson! This isn't just any AI; it's like the Einstein of artificial intelligence. From helping doctors diagnose diseases to aiding businesses in making smarter decisions, Watson is the brainy buddy every industry needs. 🧠

3. IBM Blockchain 🔗

Blockchain isn't just for crypto enthusiasts! IBM Blockchain is like a digital ledger on steroids, providing top-notch security and transparency for business transactions. It's like having a trusty notary public in your pocket, ensuring everything is legit and secure. 🛡️

4. IBM Quantum Computing ⚛️

Quantum computing sounds like sci-fi, but IBM is making it a reality. This is computing at its most powerful, solving complex problems at lightning speed. Imagine a future where new medicines are discovered faster and financial models are more accurate than ever. 🌌

5. IBM Security 🔒

In a world full of digital threats, IBM Security is like a superhero for your data. From fighting off cyber villains to safeguarding precious information, IBM has got your back. It's all about making the digital space a safer place for businesses and individuals alike. 🛡️

6. IBM Red Hat 🎩

When IBM acquired Red Hat, it was like putting together peanut butter and jelly – a perfect match! Red Hat is all about open-source software, which is basically software that anyone can tweak and improve. It's a game-changer for businesses looking to customize their tech solutions. 🤝

7. IBM Consulting Services 🧑💼

Lastly, IBM Consulting Services is like having a wise mentor for your business. Need help with a digital makeover or streamlining your operations? IBM's consultants are there to guide you through every step, combining industry knowledge with tech expertise. 👥

IBM's Competitive Edge 💪

We're zooming in on key competitive strengths that set this tech titan apart.

1. Pioneering in Innovation 🧠

First up, IBM is like the Thomas Edison of the tech industry. Their track record in innovation is nothing short of legendary. From developing the first hard drive to being leaders in artificial intelligence with IBM Watson, they've consistently been at the forefront of technological breakthroughs.

2. Global Reach with Local Impact 🌐

IBM isn’t just a big name; it’s a global powerhouse with a local touch. Picture this: offices in over 170 countries, providing localized solutions while harnessing global expertise. This means they're not just spreading their wings worldwide; they're embedding themselves in local markets, understanding and catering to specific needs. 🌍

3. Strong Business Relationships 💼

IBM's strength lies in its robust relationships with businesses of all sizes. Think of IBM as the popular kid in school who’s friends with everyone. They’ve built a network of strong, long-term partnerships with businesses, governments, and educational institutions.

Is CEO Competent and Honest? 👨💼👩💼

let's chat about a key figure at IBM – Arvind Krishna, the CEO who’s been making waves in the tech ocean.

1. A Leader with a Tech Heart 🚀

Arvind Krishna isn't just any CEO; he's a tech guy through and through. Before taking the helm in April 2020, he was the head honcho of IBM's Cloud and Cognitive Software division and played a pivotal role in the landmark acquisition of Red Hat. This move wasn't just big; it was transformative, signaling IBM's deep dive into cloud computing and open-source software. 🖥️

2. Steering IBM with Vision and Integrity 🧭

Now, let’s talk about steering. Leading a giant like IBM isn't child's play. Since Arvind Krishna took over, he's been laser-focused on growth areas like hybrid cloud and AI. But what about his honesty and competence, you ask? From all indications, Krishna is a straight shooter. He's known for being upfront about challenges and isn't shy about making bold moves to keep IBM competitive.

3. 🌈 A Blend of Innovation and Stability

One thing that stands out about Arvind Krishna is his balance of innovation and stability. He's pushing IBM towards the future with investments in cutting-edge tech, but he's also keeping the ship steady, maintaining strong relationships with IBM's vast client base.

4. The Verdict: Competent and Trustworthy? 🎯

So, is Arvind Krishna competent and honest? While no one can see through the boardroom doors, his track record so far paints the picture of a leader who's both tech-savvy and straightforward. He's steering IBM with a clear vision and an open approach, which are good signs for investors looking for stability and innovation in their portfolio.

IBM's Mission 🌍

A company's values can be a shining beacon guiding you towards wise and fulfilling investments.

1. Innovation for a Better World

IBM's mission is all about using innovation to make the world a better place. Think of them as tech wizards with a heart. 🧙♂️💖 They're not just about making cool gadgets or cutting-edge software. IBM is driven by the belief that technology should be a force for good, empowering businesses, communities, and individuals to reach their full potential.

2. Embracing the Future with IBM 🌏

As an investor, understanding IBM's values is like having a map to their future. It shows you that IBM isn’t just chasing profits; they're on a journey to use technology for good. This long-term perspective is crucial when you’re thinking about investing. It's about being part of a story where technology meets humanity, and where your investment isn’t just about financial returns, but also about contributing to positive change in the world.

Stock Prices and Returns 📈

As of 2024-10-26, the 5-year average annual stock return for IBM is 11.09%. The stock has been rising significantly in the long term. Below is a chart showing the current stock price of IBM.

Dividends 💰

As of 2024-10-26, the annual dividend rate of IBM is 3.11%. It's currently paying a decent dividend. Additionally, the dividend growth rate over the past year is 0.6% and the average annual dividend growth rate over 5 years is 0.61%. Unfortunately, the dividends are growing only slightly.

Financial Statements 📊

Let's dive into the financial statements, the 'report card' of a company. They're key to understanding its growth and figuring out if it's a smart investment choice. Join me in this exploration!

1. Revenue 🏦

Revenue is the total amount of money a company earns from selling its products. The annual revenue growth rate over the past year for IBM is 3.03%. Additionally, the average annual revenue growth rate over 5 years is -4.34%. You can see that the revenue of IBM has been decreasing over the long term. This is not a good sign.

2. Net Income💰

Net income refers to the amount a company makes after subtracting the costs of goods sold from its sales revenue. Over the past year, the net income of IBM has 314.93%, indicating a growth 📈.

Meanwhile, the average annual net income over 5 years has been -0.7%, showing a decline trend. Don't forget that the increase in net profit becomes the ultimate performance indicator for a company.

3. Debt 💳

The debt-to-equity ratio of IBM is 235%. Furthermore, when examining the debt ratio compared to net income, it stands at 675.55%. In comparison to the annual net income, IBM has a significant amount of debt.

4. ROIC (Return on Invested Capital)💰

ROIC is a measure of how much net income a company earns with the capital it has at its disposal. The current ROIC of IBM is 8.18%. A ROIC of less than 10% is disappointing. It means the ratio of net income generated to the total capital, including both equity and debt, is less than 10%. Meanwhile, the average ROIC over the last 5 years is 5.7%.

5. PER (Price to Earnings Ratio) 📊

The PER is an indicator that allows you to see how much the stock price is valued in relation to net earnings. A higher PER indicates that the stock price is overvalued. The current PER of IBM is 23.67. Also, the 5-year average PER is 30.25. Since the current PER is lower than the average, it suggests that the stock is undervalued compared to usual.

Meanwhile, the Forward PER predicted by analysts is 21.93. As better performance is expected than current, there's a possibility that the stock price might rise.

6. PSR (Price/Sales Ratio) 📊

The PSR is an indicator that helps determine how high the stock price is in relation to the sales revenue. A higher PSR indicates that the stock price is considered overvalued. The current PSR of IBM is 3.18. Also, the 5-year average PSR is 2.34. Since the current PSR value is higher than the average, it suggests that the stock is overvalued compared to normal.

7. Share Buyback 🔄

Over the past year, the company has repurchased 0.69% of its total equity, acquiring these shares as treasury stock. If IBM decides to retire these treasury shares, it could lead to shareholder value return, potentially having a positive impact on the stock price.

Advantages of Investing in IBM 🌟

Let's chat about why IBM might just be the dark horse in your investment race.

1. Steady Eddy in a World of Speedy Gonzales 🚀

IBM is like the tortoise in the famous race – steady and reliable. In the fast-paced world of tech stocks, where companies can be like shooting stars (bright, but sometimes fleeting), IBM stands out for its stability. They've been around the block (over a century, in fact!), and have weathered all sorts of economic storms. 🐢

2. Innovation Meets Experience 💡

They're constantly evolving, diving into hot areas like AI, cloud computing, and quantum computing. It's like having an experienced marathon runner who's constantly upping their game with new techniques. This blend of innovation and experience is pretty rare, and it means IBM is positioned to both protect and future-proof your investment. 🔭

3. Diversification Beyond Borders 🌍

Diversification is the name of the game in smart investing, right? Well, IBM's global footprint offers just that. With operations in over 170 countries, investing in IBM is like taking a world tour without leaving your seat. Their international presence not only spreads risk but also taps into growth opportunities worldwide.

Disadvantages of Investing in IBM ⚠️

Let's balance our scales and talk about the other side of the coin – the potential disadvantages and caveats of investing in IBM.

1. The Slow and Steady Dilemma 🐢

IBM's stability can be a double-edged sword. In the world of tech, where innovation is king, IBM’s steady approach might seem more tortoise than hare. 🐇🐢 They've been around for ages and have a strong legacy, but this also means they aren't always the first to jump on new tech trends.

2. The Challenge of Reinvention 🔄

Reinventing a century-old company is no small feat. IBM has been shifting gears, focusing more on cloud computing and AI. However, transforming such a massive ship takes time and isn't always smooth sailing. This means there might be periods of uncertainty or slower growth compared to more nimble competitors. ⏳

3. Global Footprint, Global Challenges 🌍

IBM’s vast global presence is impressive, but it also comes with its own set of challenges. Navigating different markets, regulations, and economic conditions can be complex. In some cases, this complexity can impact their agility and decision-making.

4. The Takeaway 🎯

So, what’s the verdict? While IBM offers stability and a legacy of innovation, it's important to remember that they’re in a phase of transformation, which can bring its own risks and uncertainties. Their global reach, though a strength, also presents unique challenges. As with any investment, it's all about balancing your portfolio and aligning with your risk tolerance and investment goals.

IBM's Competitors 🏆

Knowing the competitors is key to making smart investment choices.

Let's kick off with Microsoft. Think of them as the Swiss Army knife of tech – versatile and essential. 🪓💻 From Windows operating systems to the Azure cloud platform, Microsoft is a juggernaut in both consumer and enterprise tech spaces.

Next up is Amazon, but we're not talking online shopping here. Amazon Web Services (AWS) is the muscle behind much of the internet. 💪☁️ Offering powerful cloud computing services, AWS is a heavyweight champion in the cloud arena, giving IBM a run for its money with its scale, innovation, and dominance.

Google, a.k.a Alphabet Inc., is more than just our go-to search engine. 🕵️♂️🌍 With the Google Cloud Platform, they're playing a significant role in the cloud computing playground. Renowned for their strengths in data analytics and machine learning, Google is like the cool, brainy kid on the tech block.

Oracle: The Enterprise Expert 🔒

Oracle steps into the ring as a seasoned fighter in enterprise software and cloud services. 🥊🖥️ Famous for their database management systems, Oracle offers a buffet of enterprise solutions. They're like the tough, experienced contender, always ready to take on big business challenges.

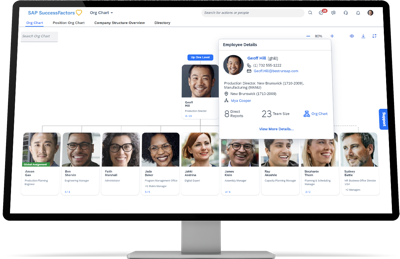

SAP: The Business Process Pro 📊

SAP is the maestros of enterprise resource planning (ERP) software. 📈🎼 SAP helps businesses orchestrate their operations, from finance to logistics. Think of them as the conductors of the business world, making sure every section of the company is in harmony.