Invest Well in Berkshire Hathaway Stock: Products, Dividend, Financial Statements, and More

2024-04-07 updated

When making long-term investments to ensure stability through diversified investments, it is recommended to prioritize ETFs that include Berkshire Hathaway stocks. However, there might still be individuals who wish to invest directly in Berkshire Hathaway stocks. Shall we also explore a value investing approach to assess whether Berkshire Hathaway's performance will grow in the long term?

Q. What products and services does Berkshire Hathaway provide?

- BH generates stable profits through long-term investments.

- BH operates businesses in various fields such as insurance, investment, energy, and consumer goods.

- BH sells various insurance products such as GEICO, General Re, and Berkshire Hathaway Life Insurance Company of Nebraska.

- BH invests in various companies in the US and around the world to generate profits.

- BH operates various energy-related businesses such as BNSF Railway and Berkshire Hathaway Energy.

- BH owns various consumer goods companies such as Dairy Queen, Fruit of the Loom, and See's Candies.

Q. What is Berkshire Hathaway's competitive advantage?

- BH owns companies in various industries to prepare for economic uncertainty and diversify risks.

- BH is growing its subsidiaries stably.

- BH generates stable profits in the long run by investing in companies with real value.

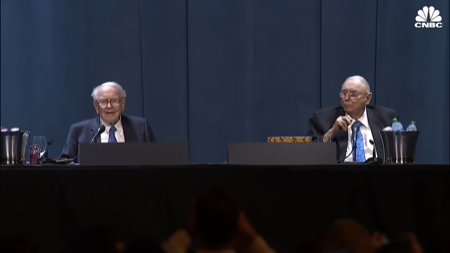

- Warren Buffett and Charlie Munger communicate honestly with shareholders about the company's management and adhere to a transparent and fair management philosophy.

Q. Is Berkshire Hathaway's executive CEO honest and competent?

Warren Buffett is the CEO of Berkshire Hathaway.

- Warren Buffett is the CEO of BH.

- Warren Buffett is a legendary investor and is called the "Oracle of Omaha."

- He is renowned for his unique perspective on long-term value investing and corporate management.

- Warren Buffett is also known for his philanthropy.

Q. Is Berkshire Hathaway's financial statements healthy?

(2024년 04월 06일 기준)

Net Profit Margin

- Berkshire Hathaway has earned an annual net profit equivalent to 10.66% of the current stock price.

- It's good to see that the net profit has been growing at an annual rate of 88.64% over the past 5 years.

Total Debt

- The debt is 130.43% of the annual net profit.

- It would take about 2 years for the company to repay all of its debt.

- The net profit is growing, so Berkshire Hathaway can repay the debt faster.

Q. What is Berkshire Hathaway's stock performance like?

- This year's total return is 40.02%.

- 5-year mean total return is 15.30%.

Q. When is a good time to buy and sell Berkshire Hathaway?

If Berkshire Hathaway is healthy and growing, it will rise in the long run, so it is good to buy in installments even if you think the current stock price is a bit high. On the other hand, if you think that Berkshire Hathaway is no longer healthy in the long run, you can consider selling.

PER

- Current: 9.46

- 5Y Avg: 5.82

- The current value is higher than the average, so be careful when buying. However, purchasing can be considered only if you judge that the company will sustain high long-term growth.

Price/Sale Ratio

- Current: 2.48

- 5Y Avg: 2.27

- Current value is higher than average so be careful when buying. However, purchasing can be considered only if you judge that the company will sustain high long-term growth.

#Long-term value investing in Berkshire Hathaway#Intrinsic value of Berkshire Hathaway#Introduction and analysis of stock#forecast#products#competitiveness#management CEO#financial statements#net income#debt#ROIC#dividend#treasury stock#return#PER#Price/Sale Ratio#philosophy#fundamental analysis

Value Investing Together is a blog and application that provides stock information for individuals interested in value investing and is not intended for investment recommendations. The information provided should only be used for reference purposes, and investment decisions should be made at one's own discretion and responsibility.