Long-term Investing in Arm Holdings Stock: Products, Dividend, Financial Statements, and More

Let's talk about Arm Holdings, a global leader in semiconductor and software design! This innovative company powers the brains behind your favorite smartphones, smart homes, and even self-driving cars. 🤖💡

Contents

Products and Services 🔍

Shall we take a look at how this company is changing our lives? ✨

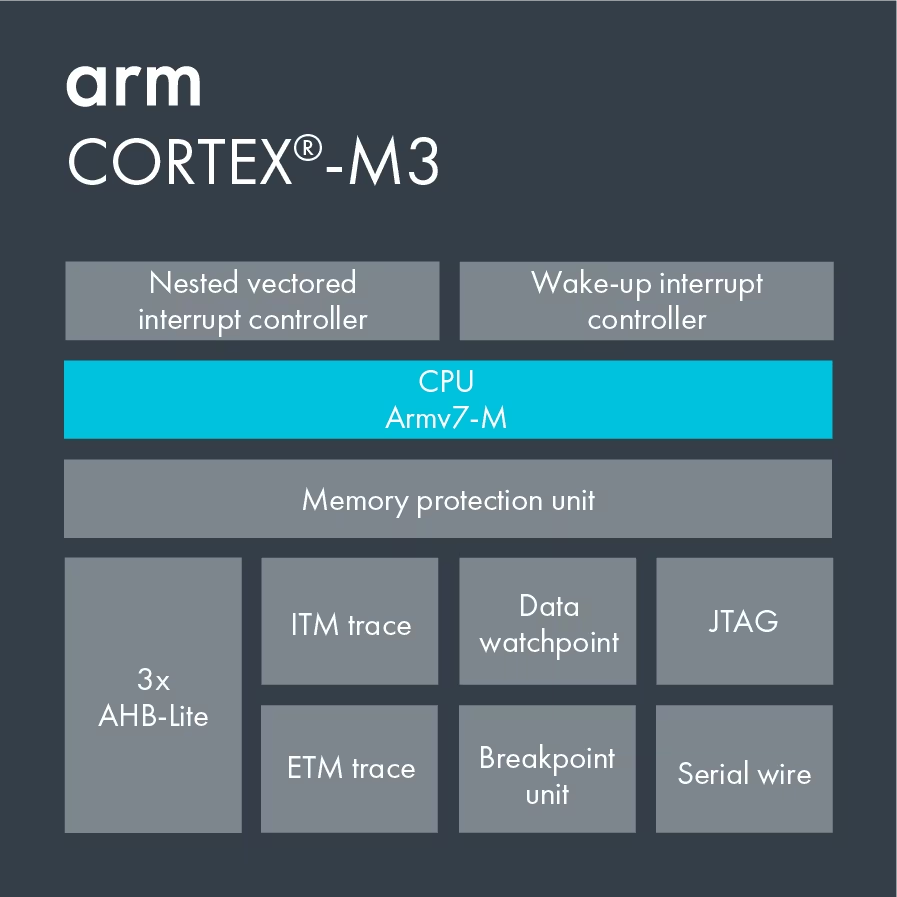

1. Arm Cortex Processors: The Brain Behind the Tech 🚀

Ever wonder what powers your smartphone or wearable device? Meet the Arm Cortex Processors! These tiny but mighty chips are like the brains of your favorite gadgets.

They handle everything from basic tasks to complex computing, ensuring that your devices run smoothly and efficiently. 💪

🎨 Arm Mali Graphics Processors: Bringing Visuals to Life

Next up, let's talk about eye candy – the Arm Mali Graphics Processors. These processors are all about delivering stunning visuals.

Whether you're gaming on your phone or watching HD videos, Mali ensures that the graphics are top-notch. 🎬

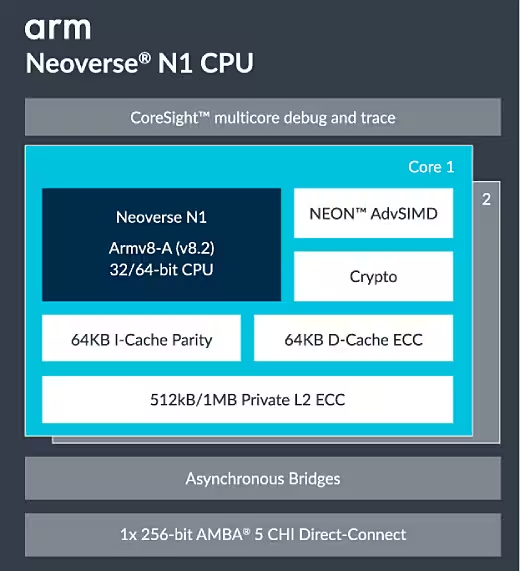

3. Arm Neoverse Solutions: Powering the Cloud and Beyond 🌐

Arm Neoverse Solutions are the unsung heroes of the data center and cloud computing world. They're designed to handle the massive amounts of data we generate and consume every day.

From streaming services to complex scientific calculations, Neoverse makes sure that data is processed efficiently and reliably. 🌍

4. Arm IoT Solutions: The Nerve Center of Smart Devices 🤖

In the world of Internet of Things (IoT), Arm IoT Solutions are king. They connect and manage the myriad of smart devices that make up our connected world, from smart thermostats to industrial sensors.

Think of it as the central nervous system that keeps everything in sync and working harmoniously. 🎼

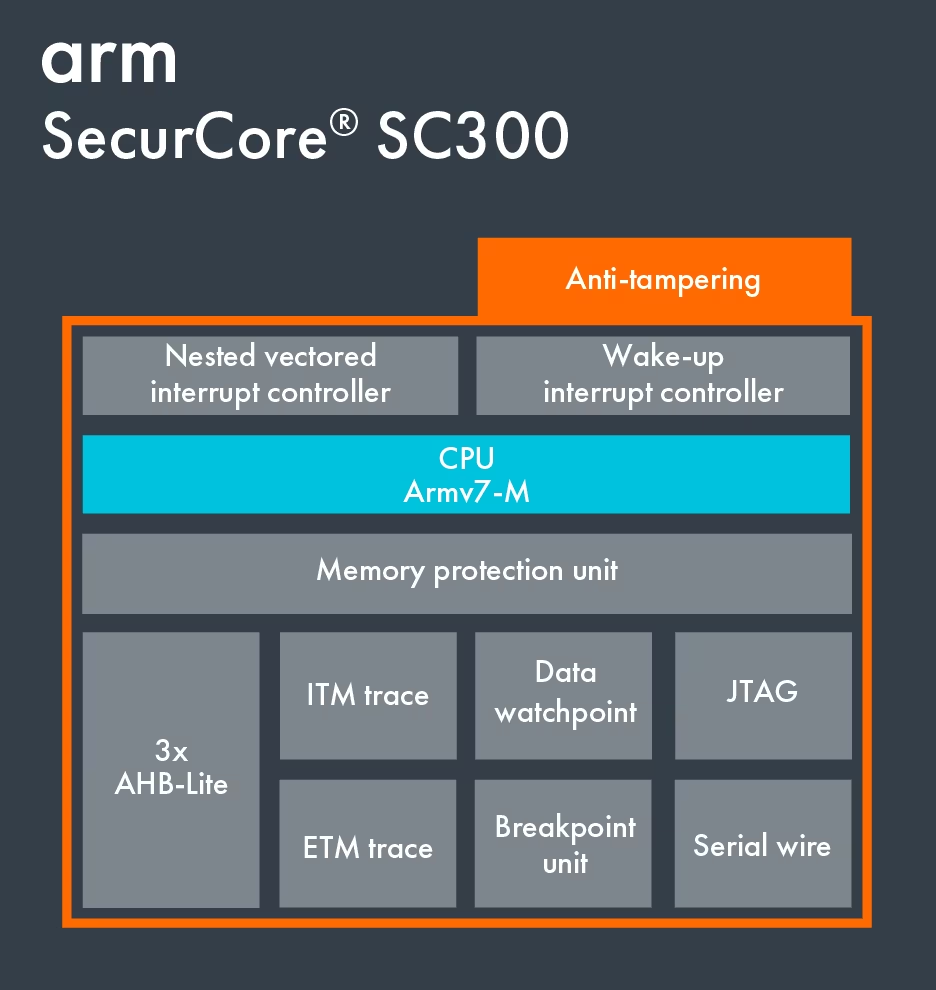

5. Arm SecureCore Technology: Your Digital Bodyguard 🔒

Security is paramount in the digital age, and Arm SecureCore Technology is like your personal digital bodyguard. It's specifically designed to protect sensitive data against increasingly sophisticated cyber threats.

Whether it's for banking, healthcare, or government services, SecureCore ensures your data is safe and sound. 🛡️

6. Arm Machine Learning (ML) Processors: The Smart Tech Magician 🧠

Arm Machine Learning (ML) Processors are at the forefront of the AI revolution. These processors are designed to learn and adapt, making your devices smarter over time.

From voice assistants to predictive text, they're constantly learning from your habits to serve you better. 🧙♂️

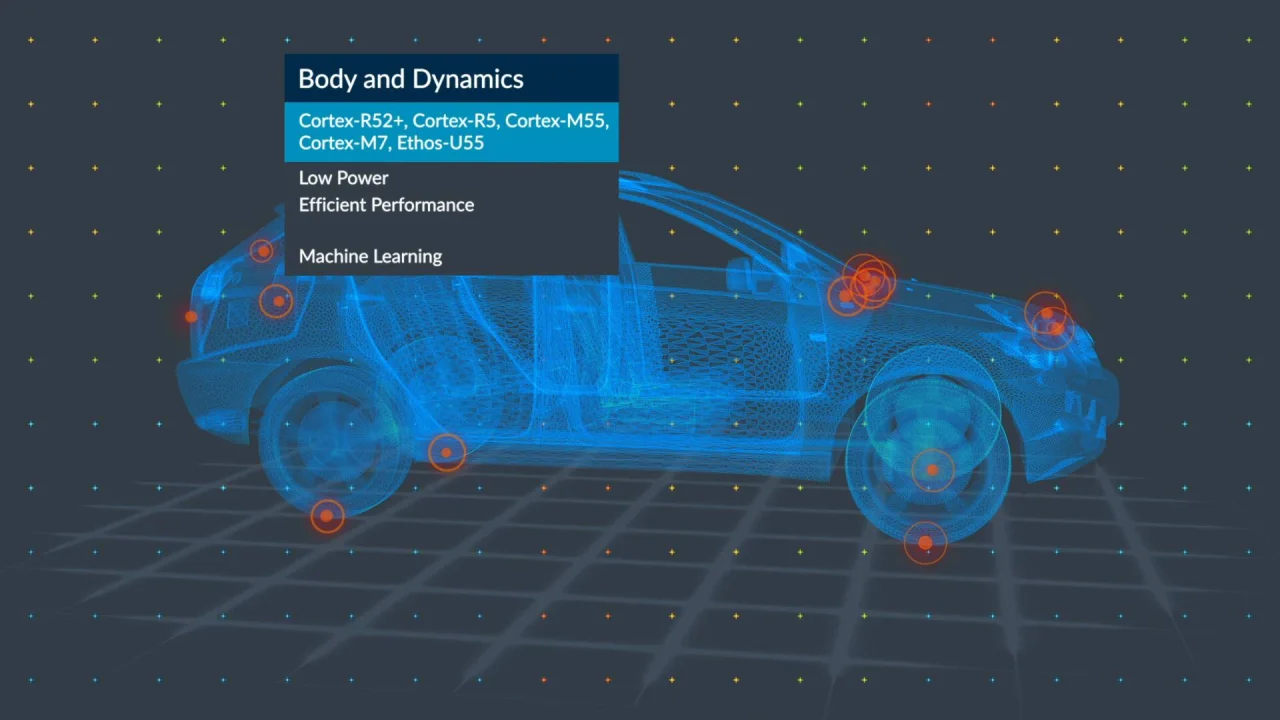

7. Arm Automotive Solutions: Driving the Future 🚗

Last but certainly not least, let's hit the road with Arm Automotive Solutions. These technologies are steering the future of transportation, from advanced driver-assistance systems to fully autonomous vehicles. 🚘

ARM's Competitive Edge 💪

ARM is not just another company; they're a trendsetter in the tech world. And that's what sets them apart in the stock market too! 📈

1. Innovation at Its Core! 🚀

First up, let's talk innovation. Arm Holdings isn't just playing the game; they're changing it. Their approach to chip design is like having a master chef in the kitchen – they create the recipe (chip design), and then other companies cook up the dish (manufacture the chips). This method has put them on the forefront of creating highly efficient, powerful chips used in everything from smartphones to smart fridges. 📱

2. Licensing Model – Smart Business, Smarter Strategy 💼

Next, let's chat about their clever business model. Arm Holdings is like the landlord of the semiconductor world. Instead of selling chips, they license their designs to other companies. This strategy is genius because it means steady income and less risk. They don't have to worry about the costs and complications of manufacturing – they just design and collect royalties. 💰

3. A Global Network of Partnerships 🌐

Lastly, Arm's strength lies in its vast web of partnerships. Imagine being at a party where you know everyone – that's Arm for you! They collaborate with a who’s who of tech companies, from Apple to Qualcomm. These partnerships aren't just for show; they ensure that Arm's designs stay relevant and widely used. 🤝

Is CEO Competent and Honest? 👨💼👩💼

We're zooming in on a key figure in the tech world - Rene Haas, the CEO of Arm Holdings.

1. The Man Behind the Wheel 🚗

First things first, Rene Haas is not just any leader; he's a maestro in the semiconductor orchestra. Taking the helm of Arm Holdings, Haas brings a wealth of experience and a track record that speaks volumes. He's like that friend who always knows the right move, whether it's in a game of chess or leading a tech giant. ♟️

2. Competence and Honesty 🛡️

When we talk about competence and honesty, Haas is a shining example. His resume reads like a tech enthusiast's dream, with stints at industry giants and a clear vision that's driving Arm towards new heights. Think of him as that reliable neighbor who always keeps his promises – he's not just talking the talk, he's walking the walk. 👣

3. A Leader for the Future 🔮

Under Haas's leadership, Arm Holdings isn't just growing; it's evolving. He's like a captain skillfully navigating through the choppy waters of the tech industry. With his at the helm, Arm is not only adapting to the changes in the tech landscape but also shaping it. He's not just playing the game; he's a step ahead, planning the next big move. ♟️

ARM's Mission 🌍

Arm Holdings isn't just about chips and semiconductors; it's about shaping a future.

1. Innovation for the Masses

Arm believes in breaking barriers. They're not just about creating cutting-edge tech; they're about making it accessible to everyone. Think of it as high-tech democracy! 🌐

2. Sustainability and Responsibility

Arm is like that friend who not only cares about the present but also deeply about the future. They're committed to creating technology that's not only powerful but also sustainable, ensuring a greener, brighter future for all. 🌱

3. Partnership and Collaboration

Imagine a world where collaboration trumps competition. Arm is making that a reality by fostering partnerships across the globe. It's all about joining hands to create something bigger and better. 🤝

Stock Prices and Returns 📈

The chart below shows ARM's current stock price and return.

Dividends 💰

Currently, ARM is not paying any dividends.

Financial Statements 📊

Let's dive into the financial statements, the 'report card' of a company. They're key to understanding its growth and figuring out if it's a smart investment choice. Join me in this exploration!

1. Revenue 🏦

Revenue is the total amount of money a company earns from selling its products. The annual revenue growth rate over the past year for ARM is 155.16%.

2. Net Income💰

Net income refers to the amount a company makes after subtracting the costs of goods sold from its sales revenue. Over the past year, the net income of ARM has 28.4%, indicating a growth 📈.

Don't forget that the increase in net profit becomes the ultimate performance indicator for a company.

3. Debt 💳

ARM currently has no debt. There's no need to worry about debt.

4. ROIC (Return on Invested Capital)💰

ROIC is a measure of how much net income a company earns with the capital it has at its disposal. The current ROIC of ARM is 3.82%. A ROIC of less than 10% is disappointing. It means the ratio of net income generated to the total capital, including both equity and debt, is less than 10%.

5. PER (Price to Earnings Ratio) 📊

The PER is an indicator that allows you to see how much the stock price is valued in relation to net earnings. A higher PER indicates that the stock price is overvalued. The current PER of ARM is 359.38.

Meanwhile, the Forward PER predicted by analysts is 104.17. As better performance is expected than current, there's a possibility that the stock price might rise.

6. PSR (Price/Sales Ratio) 📊

The PSR is an indicator that helps determine how high the stock price is in relation to the sales revenue. A higher PSR indicates that the stock price is considered overvalued. The current PSR of ARM is 42.27.

7. Share Buyback 🔄

Currently, ARM is not engaging in stock buybacks .

Advantages of Investing in ARM 🌟

Have you considered adding their stock to your portfolio? Let's dive into why Arm Holdings might just be a fantastic investment choice! 😊

1. Leading the Tech Revolution 🌐

Arm Holdings is not your average tech company. They're at the forefront of the semiconductor industry, creating the designs that power a massive range of devices, from smartphones to smart fridges! By investing in Arm, you're essentially getting a piece of the tech pie that's in almost every modern gadget.

2. Unique Business Model 💼

What sets Arm apart? Their business model! Instead of manufacturing chips, they license their designs to other companies. This approach means lower overhead costs and a broad customer base. It's like being the architect rather than the builder - less messy but equally important. 😉

3. Growing Demand for Chips 📈

The demand for semiconductors is booming, thanks to the rise of IoT (Internet of Things), AI, and 5G. As more devices get smarter and connected, the need for Arm's technology is only going to increase. It's like surfing a giant tech wave - and Arm is riding right at the crest! 🏄

4. Potential for Innovation 🌟

Arm is all about innovation. They're constantly pushing the boundaries of what's possible in chip technology. By investing in them, you're not just betting on a company; you're betting on the future of tech itself. It's like owning a piece of tomorrow's world today! 🌍

5. Strong Partnerships and Market Position 🤝

Arm doesn't go it alone; they've got powerful allies. They collaborate with giants like Apple and Samsung, ensuring their presence in top-tier products. Plus, their market position is solid, making them a reliable choice for your portfolio.

Disadvantages of Investing in ARM ⚠️

We've heard a lot about Arm's potential, but it's just as important to consider the other side of the coin.

1. High Competition in the Tech Sector 🏁

Arm Holdings operates in the highly competitive semiconductor industry. This field is packed with heavyweights like Intel and Nvidia, always racing to innovate. This intense competition means Arm needs to constantly stay ahead, which can be a challenging feat. It's a bit like a high-stakes tech marathon! 🏃♂️💨

2. Dependency on Licensing Model 💼

Arm's business model revolves around licensing its chip designs. While this is cost-effective, it also means their revenue heavily depends on the success of their licensees. If these companies face setbacks or choose a competitor's design, it could impact Arm's profits. Think of it as putting many eggs in a few baskets. 🥚🧺

3. Market Sensitivity to Technological Shifts 📉

The tech world changes rapidly, and companies like Arm must adapt quickly to stay relevant. Any major shifts in technology or consumer preferences can significantly affect their business. It's like navigating a boat in unpredictable tech waters – sometimes smooth sailing, sometimes choppy waves! 🚤🌊

4. Regulatory and Geopolitical Risks 🌍

Being a global player, Arm is subject to various international laws and trade policies. Geopolitical tensions or changes in regulations can impact their operations and profitability. Investing in Arm means being aware of these broader global factors. It's like playing chess on a world map! ♟️🗺️

5. Potential for Market Saturation 📊

As technology evolves, there's a risk of market saturation. With more companies entering the chip design space, the uniqueness of Arm's offerings might decrease over time. It's essential to monitor how Arm continues to innovate in a crowded market. Imagine a party getting too crowded – it's harder to stand out! 🎉👥

Investing in Arm Holdings, like any stock, comes with its share of risks and uncertainties. While there's potential for growth, it's crucial to weigh these disadvantages and stay informed. Diversifying your portfolio and staying updated on industry trends can help mitigate these risks. Happy and smart investing, everyone! Remember, keep your eyes open and think long-term! 🧐🌱

ARM's Competitors 🏆

Knowing the competition is key to understanding the full picture before investing. So, let's get to know these tech giants a little better! 🚀

Intel is like the seasoned athlete of the semiconductor world. They've been around since 1968, crafting some of the most powerful processors out there. Intel chips are in countless computers and servers, making them a direct competitor to Arm in the CPU market. 💻💪

NVIDIA is the Picasso of graphics processing units (GPUs). They're huge in the gaming world and are making waves in AI and deep learning. With their recent ventures into CPU development, they're stepping directly onto Arm's turf. 🖥️

Qualcomm - The Mobile Maestro 📱

Qualcomm is all about mobile. Their Snapdragon processors are found in many smartphones, directly competing with Arm's mobile processor designs. They're big on wireless technology and are playing a vital role in the 5G revolution. 🌍🔗

AMD is like the dark horse in the semiconductor race. They've been gaining serious momentum with their Ryzen CPUs and Radeon GPUs, challenging both Intel and NVIDIA.

Their innovative products and competitive pricing make them a noteworthy competitor to Arm, especially in the personal computing market. 🖥️🌟

While primarily known for its consumer products, Apple's recent shift to designing its own processors, like the M series chip, positions them as a competitor to Arm.

Their focus on integrating hardware and software creates a unique challenge, as they move towards self-reliance in chip design. 📲💡