Long-term Investing in Adobe Stock: Products, Dividend, Financial Statements, and More

Today, let's talk about Adobe, a leading pioneer in the digital creative industry. 🚀 We'll delve into how Adobe is leading the world in design and marketing, and take a detailed look at their business strategies and their position in the stock market.

Contents

Products and Services 🔍

Adobe’s suite of products showcases its commitment to empowering creativity and productivity.

1. Photoshop: Unleashing Creativity Through Images 🎨

Adobe Photoshop is the quintessential tool for image editing and digital art. It offers an extensive range of features from basic photo editing to complex digital painting.

2. Illustrator: Crafting Vector Art with Precision ✏️

Adobe Illustrator is a vector graphics powerhouse, perfect for creating scalable graphics from logos to intricate illustrations.

3. Premiere Pro: Leading the Way in Video Editing 🎞️

Premiere Pro stands as Adobe's premier video editing software. Favored by filmmakers, YouTubers, and broadcasters, it offers a comprehensive set of tools for editing, color grading, and audio mixing.

4. Creative Cloud: Your Creative Suite in the Cloud ☁️

Creative Cloud is Adobe's subscription-based model offering access to its suite of creative software. From graphic design to video editing, Creative Cloud keeps all your favorite Adobe tools in one place, updated, and accessible from anywhere.

5. After Effects: Animating the Impossible 🎬

Adobe After Effects is a powerful tool for motion graphics and visual effects. Ideal for creating animations, compositing video, and adding special effects, it's widely used in post-production for film and TV.

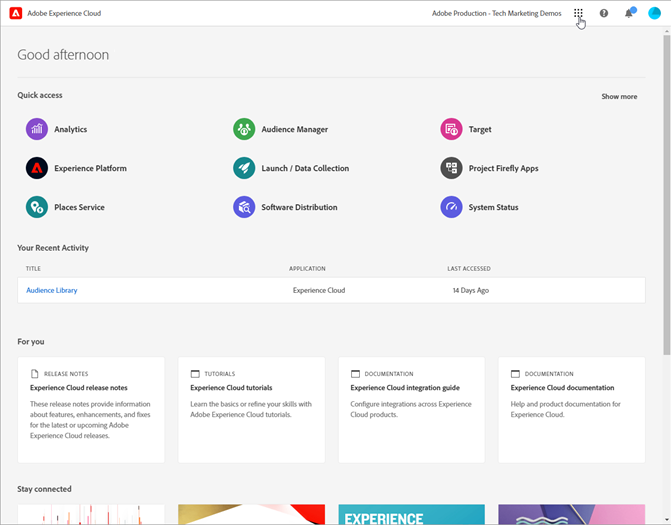

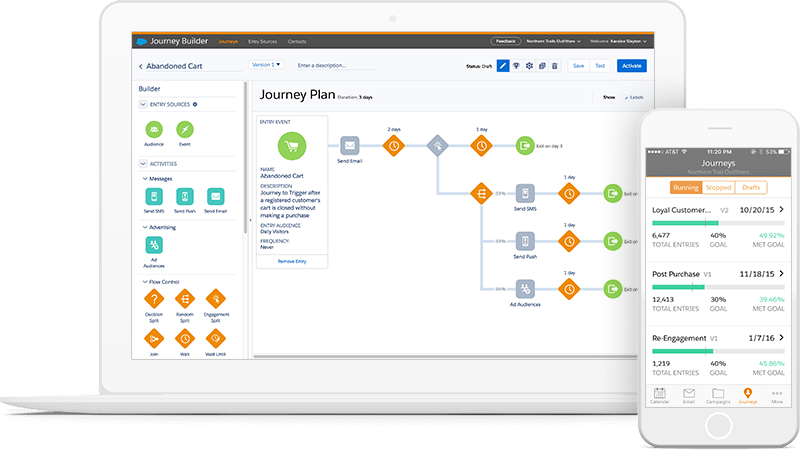

6. Adobe Experience Cloud ☁️

Adobe Experience Cloud is a comprehensive suite of marketing, advertising, analytics, and commerce tools designed to give businesses a competitive edge in digital experiences. It's like a Swiss Army knife for digital marketers!

7. Acrobat: The Standard in PDF Management 📄

Adobe Acrobat is synonymous with PDFs. It’s not just for viewing PDFs but also for creating, editing, and signing them.

8. Adobe XD: Prototyping Made Easy 🔲

Adobe XD is a user experience and user interface designing tool. It simplifies the process of creating designs for websites and mobile apps.

Adobe's Competitive Edge 💪

In the fast-paced world of technology and digital creativity, Adobe has consistently stood out as a leader. But what exactly gives Adobe its competitive edge?

1. Comprehensive Product Ecosystem 🛠️

One of Adobe's most significant competitive advantages is its comprehensive product ecosystem. With a wide array of software like Photoshop, Illustrator, Premiere Pro, and Acrobat, Adobe doesn’t just offer individual products; it provides an interconnected suite that caters to a vast range of creative needs.

2. Pioneering the Cloud-Based Subscription Model ☁️

Adobe was one of the first major software companies to shift from a traditional one-time purchase model to a cloud-based subscription model with its Creative Cloud service. This move revolutionized how software is delivered and monetized, providing Adobe with a more predictable, recurring revenue stream.

3. Global Brand Recognition and Trust 🌐

Adobe’s brand is synonymous with creativity and reliability. With decades of industry presence, it has built a reputation as the go-to source for professional-grade creative tools. This global brand recognition and trust are invaluable, especially when attracting new users or entering new markets.

Is CEO Competent and Honest? 👨💼👩💼

In the world of tech leadership, few names are as synonymous with innovation and integrity as Shantanu Narayen, the CEO of Adobe.

1. Who is Shantanu Narayen? 🤔

Shantanu Narayen joined Adobe in 1998 and has been the CEO since 2007. Born in India, he moved to the U.S. for further education and has since become a prominent figure in Silicon Valley. Narayen holds a degree in electronics engineering, a master's in computer science, and an MBA from UC Berkeley - a testament to his diverse skill set and dedication. 🎓

2. Adobe’s Transformation Under Narayen 📈

Under Narayen’s leadership, Adobe has seen phenomenal growth. He was instrumental in shifting Adobe from a software-selling model to asubscription-based cloud service. This move not only increased Adobe’s profitability but also made its products more accessible to a wider audience. 🌍

3. Narayen’s Leadership Style: Integrity and Innovation ✨

What makes Narayen stand out as a CEO? It's his commitment tointegrity and continuous innovation. Colleagues and industry experts often describe him as a leader who values honesty and transparency. He’s known for encouraging creativity and pushing boundaries, ensuring Adobe stays ahead in the competitive tech world. 🏆

Adobe's Mission 🌍

Adobe goes beyond just offering excellent software; it focuses on leading the way in creative expression and digital innovation.

1. Adobe's Core Value: Empowering Creativity 💡

At its heart, Adobe is all about empowering creativity. From Photoshop to Illustrator, Adobe's suite of products has become essential tools for digital artists and designers worldwide. Their software enables individuals and businesses to bring their visions to life, making Adobe a cornerstone in the creative industry.

2. Mission: Transforming the World Through Digital Experiences 🖥️

Adobe's mission is simple yet profound: "to change the world through digital experiences." They're not just about creating software; they're about creating experiences that touch lives and shape futures. 🚀 Whether it's enhancing photographs, designing websites, or crafting stunning videos, Adobe is at the forefront of digital expression. 🎞️

3. Innovation and Sustainability: A Forward-Thinking Approach 🌱

Adobe also prides itself on innovation and sustainability. They are constantly pushing the boundaries of what's possible in digital creativity while ensuring their operations are eco-friendly. This dual focus on creativity and sustainability makes Adobe not just a leader in technology but also a responsible global citizen.

Stock Prices and Returns 📈

The average annual stock return of Adobe over the past 5 years is 12.58%. The stock has been rising well over the long term. The chart below represents the current stock price of Adobe.

Dividends 💰

Currently, Adobe does not pay any dividends.

Financial Statements 📊

Let's take a look at the financial statements, which can be considered a report card for a company, to see if the company is growing well and whether it's worth investing in.

1. Revenue 🏦

Revenue is the total amount a company earns from selling its products. The recent annual revenue growth rate for Adobe is 10.94%. Furthermore, the average annual revenue growth rate over 5 years is 14.48%. This shows that Adobe's revenue has been growing well over the long term.

2. Net Income💰

Net income is the money a company makes after paying all its expenses, like the cost of making and selling its products.

Adobe has experienced a net income change over the last year by 4.68%, indicating growth. Meanwhile, the average annual net income over the past 5 years has been growing at 14.03%. Considering that an increase in net income ultimately reflects the company's final performance, this information can be helpful in making investment decisions.

3. Debt 💳

The debt-to-equity ratio of Adobe is 39%. This means Adobe has less debt compared to its equity, indicating that the company is managing its debt healthily. Also, when we look at the debt-to-net income ratio, it is 86.38%. Even compared to its annual net income, Adobe doesn't have a lot of debt.

4. ROIC (Return on Invested Capital)💰

ROIC is a measure of how much net income a company generates with the capital it has available to use. The current ROIC for Adobe is 29.61%. Adobe boasts a high ROIC, indicating it is generating high net income with relatively little capital. Meanwhile, the average ROIC over 5 years is 25.5%.

5. PER (Price to Earnings Ratio) 📊

The current P/E ratio for Adobe is 40.85, compared to a five-year average of 46.48. This suggests that Adobe's stock is currently trading at a discount compared to its historical average.

6. PSR (Price/Sales Ratio) 📊

Adobe's current PSR is 10.16, with a five-year average of 13.07. This suggests that Adobe's stock is currently trading at a discount compared to its historical average.

7. Share Buyback 🔄

Over the past year, the company has repurchased 4.7% of its total equity, acquiring these shares as treasury stock. The amount of treasury shares repurchased has risen compared to the three-year average. If Adobe decides to retire these treasury shares, it could lead to shareholder value return, potentially having a positive impact on the stock price.

Advantages of Investing in Adobe 🌟

Investing in Adobe stocks offers unique advantages compared to other stocks, making it an appealing choice for investors.

1. Consistent Growth and Innovation 📈

Adobe has shown a consistent track record of growth and innovation. With a strong foothold in the creative software market, Adobe continually evolves, adapting to new technological trends. This constant innovation ensures that Adobe stays relevant and profitable in a rapidly changing digital landscape.

2. Diverse Product Range 🎨

Adobe's diverse range of products caters to a wide variety of customers, from individual creatives to large enterprises. This diversity not only broadens Adobe's market reach but also provides a stable income stream. Products like Adobe Creative Cloud have become industry standards, which speaks to their reliability and market dominance.

3. Strong Financial Health 💰

Adobe's financial health is robust, with consistent revenue growth and a strong balance sheet. This financial stability makes Adobe a less risky investment compared to other stocks, especially in volatile market conditions.

4. Leadership in Digital Marketing 🌐

Adobe is not just about creative software; it’s also a leader in the digital marketing space with products like Adobe Experience Cloud. As the digital marketing sector grows, Adobe's presence in this field positions it well for future growth.

5. Embracing the Future with AI and Cloud Computing ☁️

Adobe is at the forefront of integrating AI and cloud computing into its products. This forward-thinking approach ensures that Adobe stays ahead of its competitors, offering cutting-edge solutions to its customers.

Disadvantages of Investing in Adobe ⚠️

Like any investment, Adobe stocks come with their own set of challenges and considerations.

1. High Market Expectations 📊

Adobe's success story means it often faces high market expectations. This can lead to volatility in stock prices, especially if Adobe's financial results or product launches don't meet these lofty expectations. Investors should be prepared for potential fluctuations.

2. Intense Competition in the Tech Sector ⚔️

Adobe operates in a highly competitive tech sector. Giants like Microsoft and smaller, agile companies constantly challenge Adobe's market share. This intense competition requires Adobe to continuously innovate, which can be both an opportunity and a risk.

3. Subscription Model Risks 🔄

Adobe's shift to a subscription-based model has been successful but also brings risks. Customer retention is crucial, and any decrease in subscriptions can negatively affect recurring revenue streams. Investors should monitor subscription growth and retention rates.

4. Global Economic Sensitivity 💹

Adobe's business is sensitive to global economic conditions. Economic downturns can lead to reduced spending on software and marketing solutions, impacting Adobe's financial performance.

5. Technological Shifts and Adaptation 🌐

The rapid pace of technological change means Adobe must constantly adapt. While it has been successful so far, there's always a risk of falling behind in innovation or misjudging market trends.

Adobe's Competitors 🏆

Adobe is a leader in digital media and digital marketing solutions. However, understanding its competitive landscape is crucial for investors.

Microsoft, a household name in the tech industry, competes with Adobe in several areas, particularly with its Office suite against Adobe's document solutions and in the cloud services arena. Microsoft's vast resources and diverse product range make it a formidable competitor.

Apple, known for its innovation and loyal customer base, competes with Adobe in the creative software space. With applications like Final Cut Pro and Logic Pro, Apple offers alternatives to Adobe's Creative Suite, especially for multimedia production.

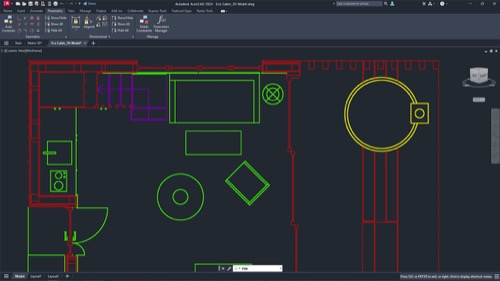

Autodesk: Leader in 3D Design 🌐

Autodesk is a leader in 3D design, engineering, and entertainment software. While it caters to a different niche than Adobe, there's overlap in the graphic design and animation sectors, with products like AutoCAD and Maya challenging Adobe's offerings.

Salesforce is a key player in the digital marketing and customer relationship management (CRM) space, directly competing with Adobe's Experience Cloud.

Salesforce's focus on CRM and marketing automation presents a significant challenge to Adobe.

Google, with its vast array of digital advertising tools and platforms, competes with Adobe in the digital marketing space. Google's Analytics, Ads, and Data Studio are pivotal in online advertising, challenging Adobe's marketing solutions.