Long-term Investing in XLK ETF for S&P500 Growth: Insights on Holdings, Dividend, Performance, and More

🌟 XLK ETF primarily invests in large-cap technology stocks, aiming to tap into the growth potential of this dynamic sector. Stay tuned as we explore what makes XLK an interesting choice for tech-savvy investors! 🚀

Contents

What is the XLK ETF?

XLK ETF is unique because it invests exclusively in technology companies within the famed S&P 500 index, which consists of 500 major U.S. corporations. 🌐

XLK includes a diverse range of tech players, spanning sectors like computer technology, software, hardware, and telecommunications. What's more exciting? It also encompasses some of the biggest names in U.S. tech, like Apple, Microsoft, and Google, making it a part of the elite 'Big Tech' club. 🖥️🍏

The real charm of XLK lies in the rapid growth of these technology companies. As the tech sector continuously innovates and evolves, XLK tends to experience a steep upward trajectory in its stock price, similar to growth stocks. However, it's important to remember that this also means significant price volatility. So, when investing in XLK, always keep this fluctuation in mind! ⚠️

Price and Returns

On October 13, 2024, let's take a moment to appreciate the performance of the XLK ETF. Over the past five years, XLK has achieved an average annual stock return rate of 23.44%! 🚀

This annual return rate of XLK is truly remarkable. However, it's essential to remember that growth stocks, like those in XLK, often experience significant price fluctuations. Whether the prices are soaring or dipping, adopting a strategy of regular, consistent investment is a wise approach. Think of it as steadily buying in, regardless of the market's ups and downs. 📉📈

Below is a chart representing the current stock price of XLK ETF. It's a handy visual to help you understand where things stand right now. 📈

Dividends and Dividend Growth

As of October 13, 2024, the annual dividend yield of XLK stands at 0.68%.It seems that XLK ETF has a relatively low dividend yield at the moment. This could be due to the nature of growth stocks typically having lower dividend yields, combined with the rapid price growth these stocks have been experiencing. 📈

Additionally, the recent 1-year dividend growth rate for XLK ETF is an 10.43%, and its average annual dividend growth rate over the past 5 years is 9.51%. 📊Although the current dividend yield of XLK is on the lower side, it appears that its dividends are growing quite healthily. 🚀

Top Holdings

The XLK ETF invests in a total of 64 companies, but let's focus on the top 10 stocks for now. This peek into the leading players within XLK will give us valuable insights into the fund's composition and strategy. 🤓

Microsoft, renowned for revolutionizing the personal computinglandscape, continues to be a driving force in the tech sector. 🖥️

With its wide range of products, from Windows operating systems to cloud services, Microsoft exemplifies the dynamic and forward-thinking nature of XLK's tech portfolio. 💡

Known for its innovative products like the iPhone andMacBook, Apple is a major contributor to the technology sector. 📱💻

Investing in XLK means indirectly tapping into the growth and creativity driven by Apple, a testament to its enduring market leadership and technological prowess. 🚀

NVIDIA is renowned for its groundbreaking work in graphics processing units (GPUs) and artificial intelligence (AI) technology. 🖥️🤖

As a part of the XLK ETF, NVIDIA's innovative spirit and market-leading products contribute significantly to the tech sector's growth and the ETF's overall performance. 💻

As a global leader in semiconductor and infrastructure software solutions, Broadcom plays a vital role in the tech industry. 🖥️

In the XLK ETF, Broadcom represents the cutting-edge of technological advancement, contributing significantly to the ETF's overall performance.

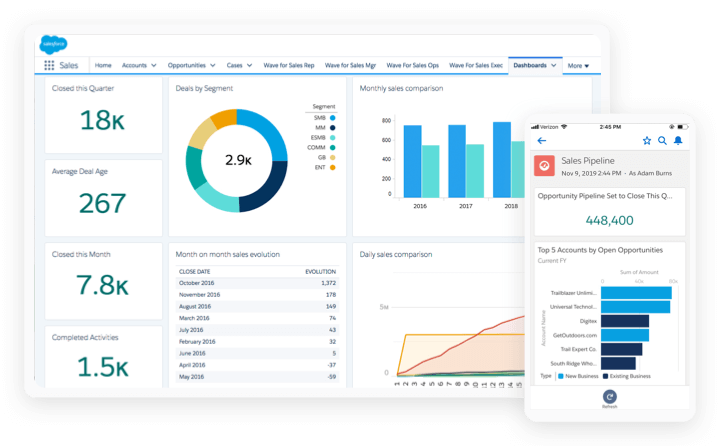

Salesforce is a leader in cloud-based software, specializing in customer relationship management (CRM). 🌐

As part of the XLK ETF, Salesforce represents the cutting-edge ofcloud computing and digital transformation, underscoring the fund's focus on innovative technology sectors.

Adobe is renowned for its extensive range of software that has transformed digital media and creativity, including popular tools like Photoshop and Acrobat. 🖥️

By investing in XLK, you tap into the innovative spirit of Adobe, a company that's redefining digital experiences and creative expression. 🌐

AMD is a powerhouse in the semiconductor industry, known for its high-performance computing and graphics technologies. 🖥️

Within the XLK ETF, AMD stands out for its role in driving technological advancements and market growth.

Accenture stands out as a global powerhouse in consulting and professional services, specializing in IT services and solutions. 💻

Investing in XLK gives you a slice of Accenture's expertise in integrating cutting-edge tech into business strategies, symbolizing the blend of technology and professional acumen. 🌟

As a leading global provider of networking solutions, Cisco plays a pivotal role in the infrastructure of the internet. 🖥️🌍

By being a part of XLK, investors are connected to Cisco's mission of powering the Internet of Everything, making it a smart choice for those looking to invest in the backbone of digital communication. 📡🚀

10. Oracle

Oracle is globally recognized for its comprehensive database management systems and cloud-engineered systems. 🖥️

By investing in XLK, you're also investing in Oracle's legacy of innovation and its ongoing role in shaping the future of enterprise IT solutions. 💻

Fees

Each year, the XLK ETF charges an expense ratio of just 0.09% of your invested capital. This means, for instance, if you invest $1000, you'll only pay $0.9 in fees per year. 🤑

This low fee makes the XLK ETF an attractive option for long-term investors looking for affordability without compromising on potential gains. 💰

Advantages of Investing in XLK

In the dynamic world of technology, XLK ETF stands out as a compelling investment option.

1. Exposure to Top Tech Companies 🏢

XLK offers you exposure to industry leaders like Apple, Microsoft, and NVIDIA. These companies are at the forefront of innovation, driving the tech world forward. By investing in XLK, you're essentially betting on the success of these tech titans! 🌐

2. Diversification 🌈

Diversification is key in investing. With XLK, you're not just investing in one company but a range of companies across the tech sector. This spreads out your risk and can lead to more stable returns. 🛡️

3. Growth Potential 📊

Technology is a rapidly growing sector. With advancements in AI, cloud computing, and more, tech companies are continually evolving. This means XLK has the potential for significant growth, making it an attractive option for long-term investors. 🚀

4. Convenience and Lower Costs 🎯

ETFs like XLK offer convenience. Instead of buying individual stocks, you get a diversified portfolio in one transaction. Plus, ETFs generally have lower fees compared to mutual funds, making them a cost-effective option. 💰

5. Liquidity 💧

As an ETF, XLK is traded like a stock, meaning you can buy and sell shares easily during market hours. This liquidity is a huge plus, especially if you need to adjust your portfolio quickly. 🏃♂️💨

Disadvantages of Investing in XLK 🚨

As always, it's crucial to balance the excitement of potential gains with a clear understanding of the risks and cautions. Let's explore!

1. Market Concentration Risk 🎯

XLK ETF is heavily concentrated in the technology sector. This means, if the tech sector sneezes, XLK catches a cold! It's putting many eggs in one industry basket, which can be risky if the tech sector faces a downturn. 📉

2. Volatility 🌪️

Tech stocks can be like a rollercoaster - exciting but not for the faint-hearted. The technology sector is known for its high volatility. Rapid changes in technology and market trends can lead to significant price swings. 🎢

3. Obsolescence Risk 🕰️

Technology is ever-evolving. Today's hot gadget can quickly become tomorrow's old news. Investing heavily in tech means you're exposed to the risk of obsolescence as newer technologies replace older ones. 💻

4. Interest Rate Sensitivity 📊

Tech stocks can be sensitive to interest rate changes. Higher interest rates can lead to lower profit margins for tech companies, affecting their stock prices and, consequently, your investment in XLK. 📉

5. Overvaluation Concerns 🤯

Some analysts argue that tech stocks, due to their popularity, can be overvalued. This overvaluation can lead to corrections, affecting the performance of XLK. 💸

Investing in XLK ETF can offer exposure to the dynamic technology sector, which has the potential for high returns. However, it's important to be aware of the risks and diversify your investment portfolio to mitigate these concerns. Remember, don't put all your tech eggs in one basket! 🧺

Competitive Products

While XLK is a fantastic tech ETF, alternatives offer unique flavors and diversification opportunities in the tech space. 😊

1. VGT (Vanguard Information Technology ETF)

VGT includes more mid-cap and small-cap companies compared to XLK, offering broader exposure to the tech sector. 🌟

2. FTEC (Fidelity MSCI Information Technology Index ETF)

FTEC aims to provide investment returns that correspond generally to the performance of the MSCI USA IMI Information Technology Index.

Known for its lower expense ratio, FTEC is a cost-effective option for investors. 💰

3. IYW (iShares U.S. Technology ETF):

IWY ETF is similar to XLK but with a slightly different mix of tech stocks, providing a fresh perspective on the tech sector. 🎨

QQQ is a bit different. It tracks the NASDAQ-100 Index, which is heavily weighted towards tech, but also includes companies from other sectors.